In the July Issue

- Tempo Opportunity Fund LLC Structure

- How Investors Receive Unrealized Gains

- Current Snapshot of Fund Performance and Earnings

As the Economy Slows, Private Investment Funds Provide Opportunity

Based on market indicators, the US economy continues to slow down on the whole, suggesting a possible recession in the second half of 2019 into 2020. For one, we’re in an inverted yield curve environment in which 1-6 months treasury yields are higher than 10-year yields. Additionally, the FED, despite their initial plan for a total of three rate increases for 2019, is now preparing to cut rates as early as this summer. When you factor in the ongoing “trade war” with China as an additional uncertainty for markets, the environment appears tailor-made for a recession. With all of this unpredictability swirling around in the face of a declining market, investors weighing their options would be wise to consider cash-yielding opportunities and stable assets in which to place their capital. The Tempo Opportunity Fund LLC is an attractive option to consider in light of these trending economic conditions.Why the Tempo Opportunity Fund LLC? A Look Into Our Privately Offered Fund

One of the primary advantages of our fund has to do with our overall philosophy: we’re relationship-driven. As such, we’re able to negotiate the best access points on all of our deals and the best types of opportunities that are not available to the public. It’s one of the key competitive edges investing in a fund; the access one has through a network, rarely if ever, can be replicated in individual deals “on the street.” Plainly put, an investor can get access to strong deals through our network that cannot be accessed individually. More than half of our portfolio is in hard money loans, secured by mortgages or deeds of trust as well as Fix-and-Flip or Fix-and-Refi projects. The properties are then sold to investors as turn-key properties. If investors aren’t interested in buying them, first-time home buyers love them. In terms of what we’re seeing on the economic horizon, these properties aren’t typically affected by economic slowdown. Whereas high-end properties tend to lie in dormancy or go vacant, affordable properties are in demand due to the fact that people need somewhere to live. This is the basis behind our fund investing in turn-key range properties. In addition, we invest in equity deals: self-storage, multi-family, and retail shopping centers. These present tremendous investment opportunities despite the Amazon effect which has made many people nervous. Here, we’re able to pick up great assets at cheap prices. We’ve seen conversions from retail to service-oriented and experiential types of businesses which makes a lot of sense to us. In addition to the above, we invest in two other funds and syndications with access to their best units, even in cases of smaller amounts of money, due to the fact that we invest in so many of their deals. We also invest in office and industrial, portfolios of single-family, and other real estate transactions. On the whole, we’ve been pleased with the degree to which these assets have remained impervious to shifting economic tides and trends.

Tempo Opportunity Fund LLC Structure

The Tempo Opportunity Fund LLC’s focus is value-add equity investments and Fix-and-Flip hard money loans. The fund’s preferred return is 7% with a total return target of between 10-13% NET to investors. Our management fees are 2%. Then, there is a performance split depending on the class of the units. See the chart below for a breakdown of performance split: Performance split (above the 7% Pref):-

- A Units: 80/20 ($1,000,000+ invested)

-

- B Units: 70/30 ($500,000 – $999,999 invested)

- C Units: 60/40 ($100,000 – $499,999 invested)

Historical Fund Performance

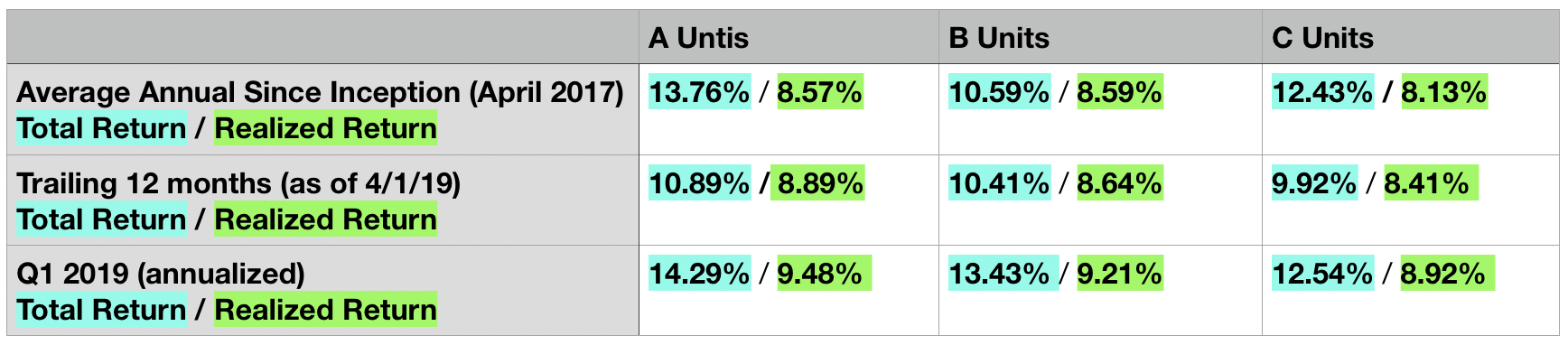

Like we mentioned above, our NET target return for investors is between 10-13%. ***It’s important to note that during times of economic slowdown, the returns may not be as high as expected, so we like to be conservative with our estimates. Let’s take a look at the fund’s historical performance since April 2017. If you look at Q1 2019, the Tempo Opportunity Fund LLC had a really strong quarter. Total returns for class A, B, and C shares are above the target range. You can see mid-twelves for class C, mid-thirteens for class B, and sort of mid-fourteens for class A. The blue numbers are total return, and the green numbers are distributable cash. *Investor Note: Total return is a combination of cash, realized income, and appreciation. The Class B units are an exception in that they’ve been around for less than the full time– that’s why the numbers are a bit lower. But class C and class A provide good examples of instances in which we are well within the 10-13% target range.

As of January 1, 2019, our Net Asset Value was $13,032,000, while our Projected Fund Capital as of April 1, 2019, was $15,500,000.

The Class B units are an exception in that they’ve been around for less than the full time– that’s why the numbers are a bit lower. But class C and class A provide good examples of instances in which we are well within the 10-13% target range.

As of January 1, 2019, our Net Asset Value was $13,032,000, while our Projected Fund Capital as of April 1, 2019, was $15,500,000.

How Investors Receive Unrealized Gains

In the chart above you’ll note that we’re reporting a 13% total return but only a (roughly) 9% distribution. This begs the question, “Where’s the other 4%?” Logically, investors will want to know when they’re going to receive their unrealized gains or appreciation fee. But first, what do we mean by “unrealized gain?” An unrealized gain is an increase in the value of an asset that is not yet sold for cash, a.k.a. “paper profit.” In effect, unrealized gains translate to a higher price per unit, working similarly to an investment in a stock or mutual fund. An unrealized gain becomes a realized gain upon sale of the asset by the fund. Here are two ways how unrealized gains can convert to realized gains:-

- Unrealized gains translate to higher price per Unit

-

- Unrealized gains turn into Realized gains upon sale of asset(s) by the Fund

How the Fund Derives Its Income and Growth

The way the fund derives its income is straightforward… through realized income or gains (which come in the form of points collected), interest collected on hard-money loans, cash distributions, and equity projects. Although we can set aside some loss reserves and accounting reserves, most of the income is distributable on a quarterly basis. Growth comes in as unrealized gains or appreciation, and most of the projects we invest in have what’s known as forced appreciation (appreciation caused by increased value due to repairs, renovations, etc.). Total Return = Realized Income (“Distributable income”) + Unrealized Income (“Growth or Appreciation”) *Ultimately, unrealized gains convert to realized gains in the sale of the units or the sale of an asset.A Current Snapshot of the Tempo Opportunity Fund LLC Earnings and Performance

As stated above, our investment portfolio is real estate with more than half of our investments in hard-money loans secured by mortgages or deeds of trust. Typically, these consist of Fix-and-Flip projects or Fix-and-Refi. We also invest in the following equity deals and syndications:- Self-Storage

- Multifamily

- Retail / Shopping centers

- Office

- Industrial

- Short Sale & Foreclosure Portfolio(s)

Tempo Opportunity Fund’s Current/In-Progress Deals

Here’s an overview of our current deals followed by a look at the portfolio’s current performance. In the second half of fiscal year 2019, the Tempo Opportunity Fund LLC is looking at investing in the following deals:- Hard-money loans on fix-n-flip deals in the AFFORDABLE housing range

- Turn-keys, entry level new construction

- 1st lien NPN/NPL at low LTV

- Value-add retail at discounted prices, with strong cashflow, conservative leverage, and very experienced operators

- Some commercial hard money (short-term / long-term) real estate debt

- Conversions (to Self-Storage, or residential units)

- Fast conversion projects, and much less ground up

When we put money to work on deals including hard-money loans or any long-term equity investment, we don’t get any estimation fee– we only get paid through the waterfall model. We are motivated by a single driver: to deliver maximum performance to our investors.

Want to Learn More About Investing?

If you’re interested in learning more about how you can invest in the Tempo Opportunity Fund LLC, please visit http://secure.tempofunding.com or contact me, Mike Zlotnik, at mike@tempofunding.com or by phone (917-806-5029). I’ll be happy to forward you the PPM, term sheets, and subscription paperwork or answer any questions you might have.

Thanks for reading!

Mike Zlotnik

CEO, TF Management Group LLC

This newsletter and its contents are not an attempt to sell securities, nor to sell anything at all, nor provide legal, nor tax accounting, nor any other advice. The presenter is a private lending and real estate fund management business, and the information represented herein are purely for educational purposes and represents the opinions of the presented. Prior to making any investment or legal decision you should seek professional opinions from a licensed attorney, and a financial advisor.

TF Management Group LLC (TFMG) is an investment fund management company that specializes in both short-term debt financing for real estate “fix and flip” projects, and long-term “value-add” equity deals.