In the August Issue

- A Look at the Current Economic Market

- Which Investment Quadrants to Invest in During a Downward Market

- Our Investment Advice for 2019

Are We Headed Toward a Recession?

It’s important for us to have a clear understanding of what’s going on with the economy today in order to shape our investments for the future.

It’s pretty clear that economic expansion is at the peak of its cycle and that a slowdown is inevitable. And although we’re not in a technical recession yet, we’re getting there. Generally, with an inverted yield curve, which we’ve had for a bit, recession follows within a year. In simple terms, this is characterized by short term debt instruments (1-3 month & 1-year rates) producing greater yields than longer term debt instruments (10-year rates, for example).

Just six months ago the FED was considering rate hikes, but now they’ve gone in a neutral-reverse direction and are talking about cutting rates because GDP growth and inflation expectation is lower than projected.

Another key indicator the FED is closely monitoring is new job creation which is not keeping pace with the number of people entering the labor force. With new jobs lagging, we’re likely to see increases in unemployment, and this creates stimulus for the FED to cut rates. They will want to prepare for a soft landing and be proactive, and the last thing they want to do is be behind the curve.

Let’s not downplay the fact that the economy is still rolling along pretty well at the moment; the stock market is near its highest historic mark and housing stats are also good. But the feeling is that we’ve been running on a sugar high for far too long and that the laws of economics will kick in eventually. If the FED does what they’re supposed to, we may have a moderate recession, but we should be realistic that a recession is coming.

Also, many asset classes are fully priced (if not overpriced), and CAP rates are still historically low, so it’s not as easy to find quality deals at a good price. We’re still seeing strong demand for affordable housing units, but high-end units are in a slowdown.

So, what happens in this type of environment when the economy slows down? What is the primary opportunity?

One thing is for certain:

the conditions leading to a slowdown are both creating and further accelerating distressed debt opportunities.

Revisiting the Investment Quadrants

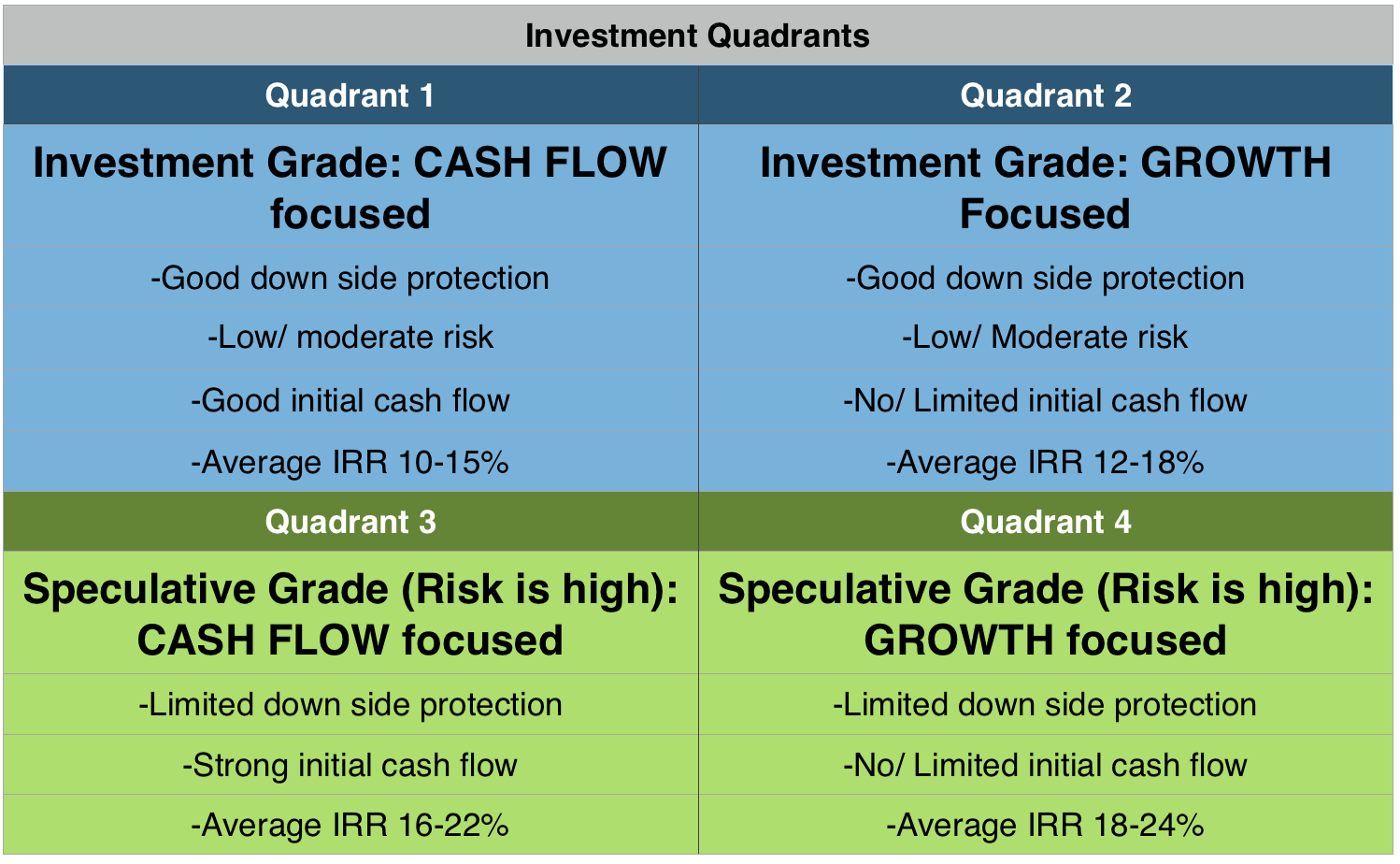

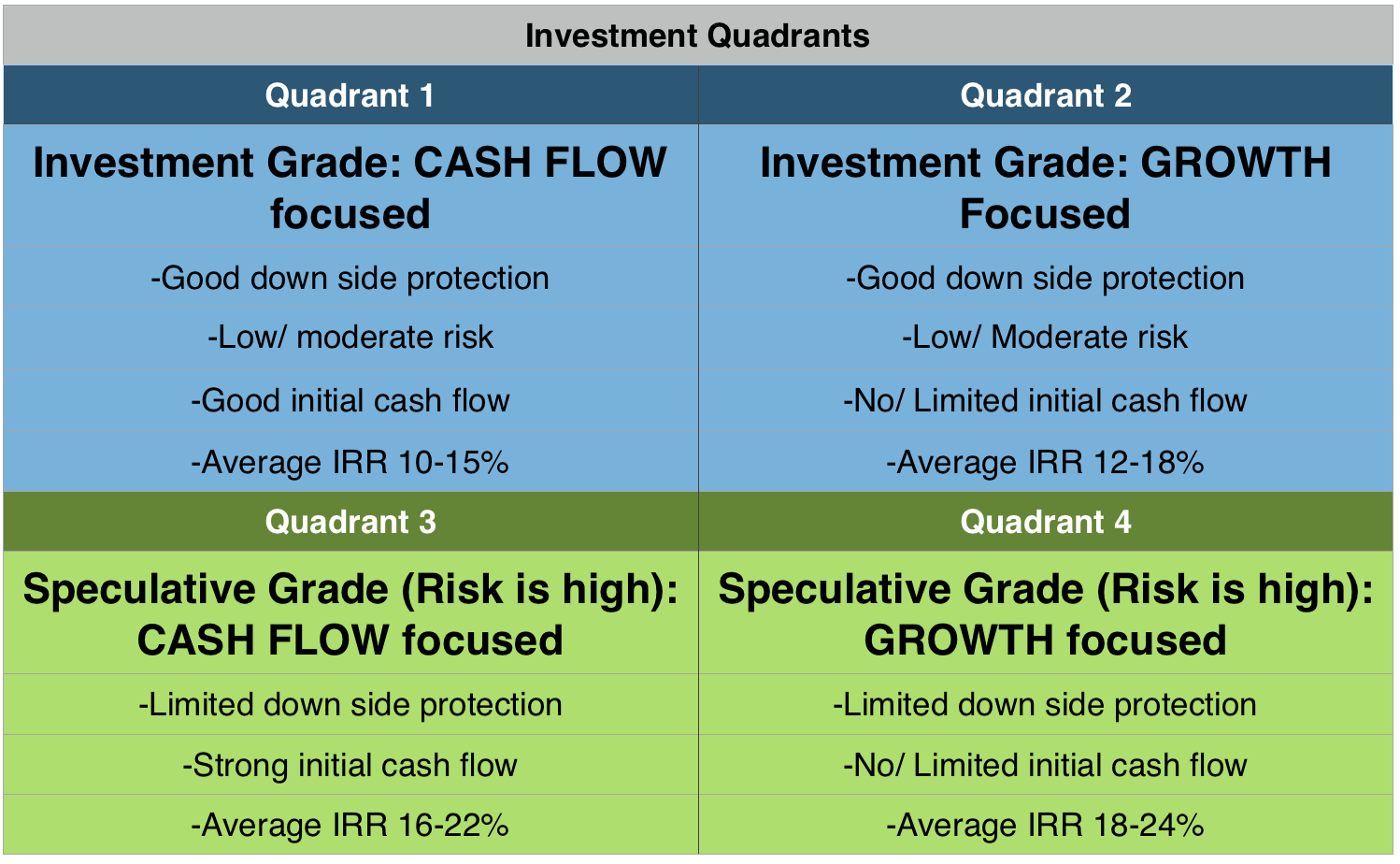

Before we discuss the types of opportunities available in an economic downturn, let’s revisit the four investment quadrants.

Quadrants one and two are Investment Grade while quadrants three and four are Speculative Grade. Downside protection is strong in quadrants one and two but is very limited in three and four. Quadrants one and two also have low to moderate risk associated with them while the speculative quadrants are high risk.

*Investor Note: Because of this fact, in today’s environment, I encourage people to invest in quadrants one and two.

Quadrant one, which is cashflow focused, is 1st lien performing notes with some moderate leverage equity for projects. Quadrant two, which is growth focused, is 1st lien non-performing notes and value-add projects with light to moderate leverage.

Quadrant three is characterized by aggressive lending with second lien paper and more aggressive equity deals with higher leverage. Quadrant four consists of speculation through development, redevelopment, and land speculation with little, if any, initial cashflow.

Return on Investment

In terms of ROI, the average in quadrant one is

10-15%, quadrant two is

12-18%, quadrant 3 is

16-22%, and quadrant four is

18-24%. So, you can see that even in quadrant one, if you pick your projects carefully, your ROI has potential to be very strong; no doubt, some people will question whether it’s still possible to get these rates in an economic downturn.

I believe the answer is yes, but It’s more likely to be

8-13%, so expectations may need to be tamped down in a sluggish environment.

Even in a downturn, real estate provides phenomenal opportunities along with predictable, relatively low risk returns with good depreciation and other benefits. Quadrant one deals will continue to be out there.

Quadrant two deals should accelerate as the economy turns, and we should see distressed debt opportunities all over the place. The average ROI in quadrant two should be high since the investor needs to be compensated for foregoing cashflow. A similar concept applies to quadrants three and four regarding ROI. If you’re willing to speculate, you need to see higher upside in these projects–otherwise, why invest?

Let’s not forget that all projects, even investment grade, have risks associated with them and there are no guarantees, ever. If you want a truly safe investment, go with government bonds (which I’m afraid also have risks due to interest rate fluctuation unless you hold the paper to the end of maturity).

Risk Adjusted Return

RAR math is pretty straightforward:

RAR = Projected Return – Loss Reserves. Loss reserves is a mathematical formula that adjusts for the risk of a given project.

Loss reserves for investment grade versus speculative grade varies quite a lot based on market conditions. As economic conditions change, volatility will fluctuate.

With Investment Grade projects, loss reserves are not that high. My projected range is 1-3% with an average of 2%. Even with an economic downturn, this shouldn’t change drastically unless we head into a major recession. So, if it’s a moderate recession, loss reserves shouldn’t change due to downside protections (plus the fact that investment grades are geared to handle stressed conditions.)

Speculative grade projects are quite different when it comes to loss reserves. There a lot of associated risks and, as a result, loss reserves are much higher. Here, I use a range from 5-20%.

If your project is expected to generate a 40% return with a loss reserve of 20%, your RAR will be 20%. These change a great deal based on economic conditions. If you invest in a ground up speculative project, for example, and they don’t sell, you lose all your money. There’s no downside protection. In a good market condition, I like to use 6-7% loss reserves. If the market turns bad, that number goes up.

Summarizing RAR for the Quadrants

In quadrant one, starting with a range between 10-15%, if you apply 1% loss reserve, you end up with a target range ROI of 10-14%; in quadrant two, you start with 12-18%, if you apply a 2% loss reserve you end up with a Risk Adjusted ROI of 10-16%. Similarly in quadrant three and four, if you adjust the projected ROI by 6% loss reserve, your Risk Adjusted ROI falls quite a bit.

As long as you’re comfortable in these projects, you can still invest in them, but choose carefully in the speculative quadrants because with their kind of returns, they tend to go down together. When the economy is good, very few fail. However, in the climate we’re projecting, many speculative projects will be at risk.

Investment Advice for 2019

Understanding and Managing Risks:

It’s important that you take the time to understand your risks in order to manage and mitigate them. As part of your investment strategy, the number one rule is diversification, and you should be sure to diversify in every dimension.

As we mentioned earlier, interest rates were initially rising but now they’re slowing. This creates an opportunity to get a better rate on a refinance. (If you reduce your leverage, it can get even better). Lower interest rates and lower payments provide better access to inexpensive capital.

As prices go down, focus on cashflow. If your cashflow is good there’s much less concern about what a property is worth, theoretically, if you were to sell today.

In addition, I like projects with multiple exit strategies. In other words, I prefer them to have a value-added component, and then completion of the value-add strategy. Upon competition, value-adds have two strategies: option one is to refinance and option two is to flip; both are valid strategies as long as they can execute at least on the refinance. Then you can keep the asset and not worry about selling.

Recession Resistant Sectors You Should Consider:

- Self-storage

- Affordable Entry-Level Housing

One word of caution about self-storage: there have been a lot of growth trends of late, and there is more supply than demand in some markets. Just be certain that if you enter into a project that you’ve assessed the locale carefully–if a competitor ends up building something similar next door, you’ll have to deal with the local competitive situation.

You should also consider investing in projects with forced appreciation as a value-add strategy.

Recap: Best Investment Advice

So, to sum up my investment advice, diversify, diversify, diversify! Make sure that you invest with significant downside protection. Be sure to focus on cashflow, and as stated just above, concentrate on areas of lower volatility and greater predictability. Don’t forget to use smart, conservative leverage. Remember what we said in our discussion of the quadrants: it’s all about

Risk Adjusted Return!

Should You Invest in Individual Deals or Funds?

Let’s look at both individual deals and funds and determine which is best in a slowing economy.

Individual deals are characterized by the following:

- Risk concentration and high volatility

- Low Liquidity

- Personal guarantee might be required on mortgages

- Potential liability risks

- More active involvement

- Idle funds between investments

- IRA investors–risk of UBIT on debt leveraged deals

- Must have the right amount of cash

Funds characteristics:

- Diversification and low volatility

- Better liquidity (depending on the fund type)

- No personal guarantee

- Limited liability risks

- Completely passive investment

- Funds are always working

- IRA investors–no UBIT if there is no debt leverage at the fund level

- Flexible (add/reinvest distributions)

Based on some of the elements I’ve discussed in earlier section of the newsletter, it should be apparent that funds are more in line with the types of investments I’m recommending during a slowing economy.

Final Thoughts

Each of these strategies will enable you, as an investor, to reduce your risk in the age of rising interest rates. Taken alone, they are powerful strategies, but given the current market climate of potential rising interest rates, they are even more valuable.

What if rising interest rates have a less dramatic downward influence on the market? Even if the market continues to climb, these strategies will not hurt your investment portfolio. They will simply add a more conservative aspect to it so you can rest at night knowing if the market does take a downward turn, your investments are safer.

Finally, it’s important to remember that with the right perspective and strategy, rising interest rates simply bring new opportunities for investors.

If you’re interested in learning more about how you can invest in the Tempo Opportunity Fund LLC, please visit

http://secure.tempofunding.com or contact me, Mike Zlotnik, at

mike@tempofunding.com or by phone

(917-806-5029). I’ll be happy to forward you the PPM, term sheets, and subscription paperwork or answer any questions you might have.

Thanks for reading,

Mike Zlotnik

CEO, TF Management Group LLC

This newsletter and its contents are not an attempt to sell securities, nor to sell anything at all, nor provide legal, nor tax accounting, nor any other advice. The presenter is a private lending and real estate fund management business, and the information represented herein are purely for educational purposes and represents the opinions of the presented. Prior to making any investment or legal decision you should seek professional opinions from a licensed attorney, and a financial advisor.

TF Management Group LLC (TFMG) is an investment fund management company that specializes in both short-term debt financing for real estate “fix and flip” projects, and long-term “value-add” equity deals.

Quadrants one and two are Investment Grade while quadrants three and four are Speculative Grade. Downside protection is strong in quadrants one and two but is very limited in three and four. Quadrants one and two also have low to moderate risk associated with them while the speculative quadrants are high risk.

*Investor Note: Because of this fact, in today’s environment, I encourage people to invest in quadrants one and two.

Quadrant one, which is cashflow focused, is 1st lien performing notes with some moderate leverage equity for projects. Quadrant two, which is growth focused, is 1st lien non-performing notes and value-add projects with light to moderate leverage.

Quadrant three is characterized by aggressive lending with second lien paper and more aggressive equity deals with higher leverage. Quadrant four consists of speculation through development, redevelopment, and land speculation with little, if any, initial cashflow.

Quadrants one and two are Investment Grade while quadrants three and four are Speculative Grade. Downside protection is strong in quadrants one and two but is very limited in three and four. Quadrants one and two also have low to moderate risk associated with them while the speculative quadrants are high risk.

*Investor Note: Because of this fact, in today’s environment, I encourage people to invest in quadrants one and two.

Quadrant one, which is cashflow focused, is 1st lien performing notes with some moderate leverage equity for projects. Quadrant two, which is growth focused, is 1st lien non-performing notes and value-add projects with light to moderate leverage.

Quadrant three is characterized by aggressive lending with second lien paper and more aggressive equity deals with higher leverage. Quadrant four consists of speculation through development, redevelopment, and land speculation with little, if any, initial cashflow.

Mike Zlotnik

CEO, TF Management Group LLC

This newsletter and its contents are not an attempt to sell securities, nor to sell anything at all, nor provide legal, nor tax accounting, nor any other advice. The presenter is a private lending and real estate fund management business, and the information represented herein are purely for educational purposes and represents the opinions of the presented. Prior to making any investment or legal decision you should seek professional opinions from a licensed attorney, and a financial advisor.

TF Management Group LLC (TFMG) is an investment fund management company that specializes in both short-term debt financing for real estate “fix and flip” projects, and long-term “value-add” equity deals.

Mike Zlotnik

CEO, TF Management Group LLC

This newsletter and its contents are not an attempt to sell securities, nor to sell anything at all, nor provide legal, nor tax accounting, nor any other advice. The presenter is a private lending and real estate fund management business, and the information represented herein are purely for educational purposes and represents the opinions of the presented. Prior to making any investment or legal decision you should seek professional opinions from a licensed attorney, and a financial advisor.

TF Management Group LLC (TFMG) is an investment fund management company that specializes in both short-term debt financing for real estate “fix and flip” projects, and long-term “value-add” equity deals.