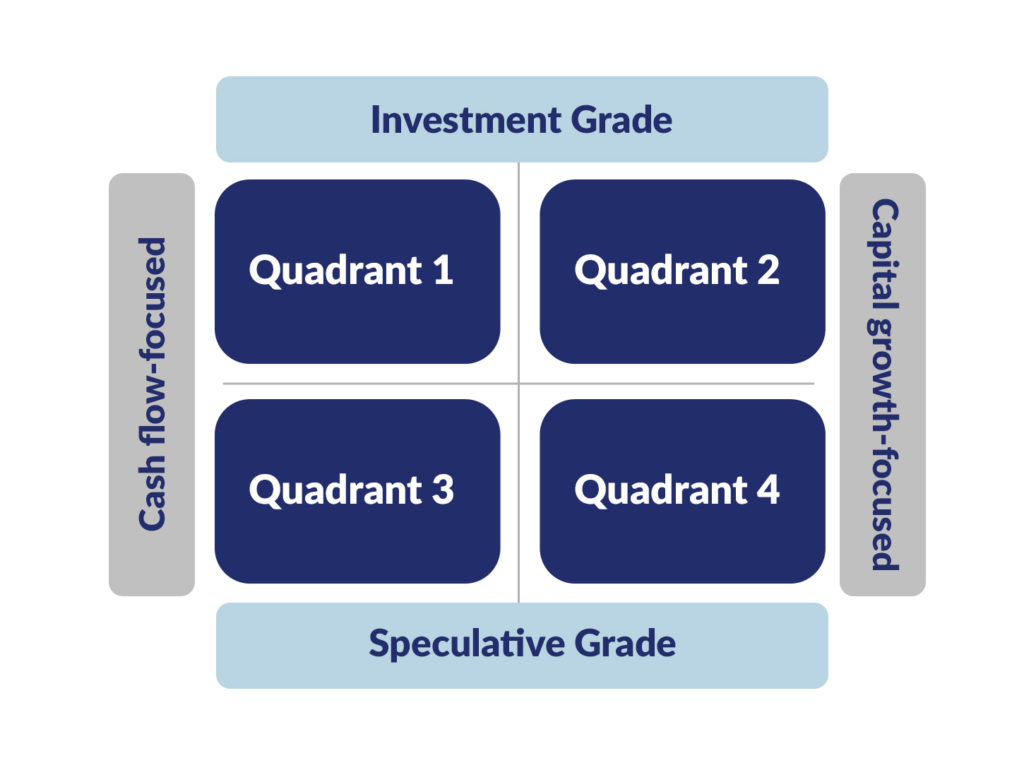

What is the investment quadrant?

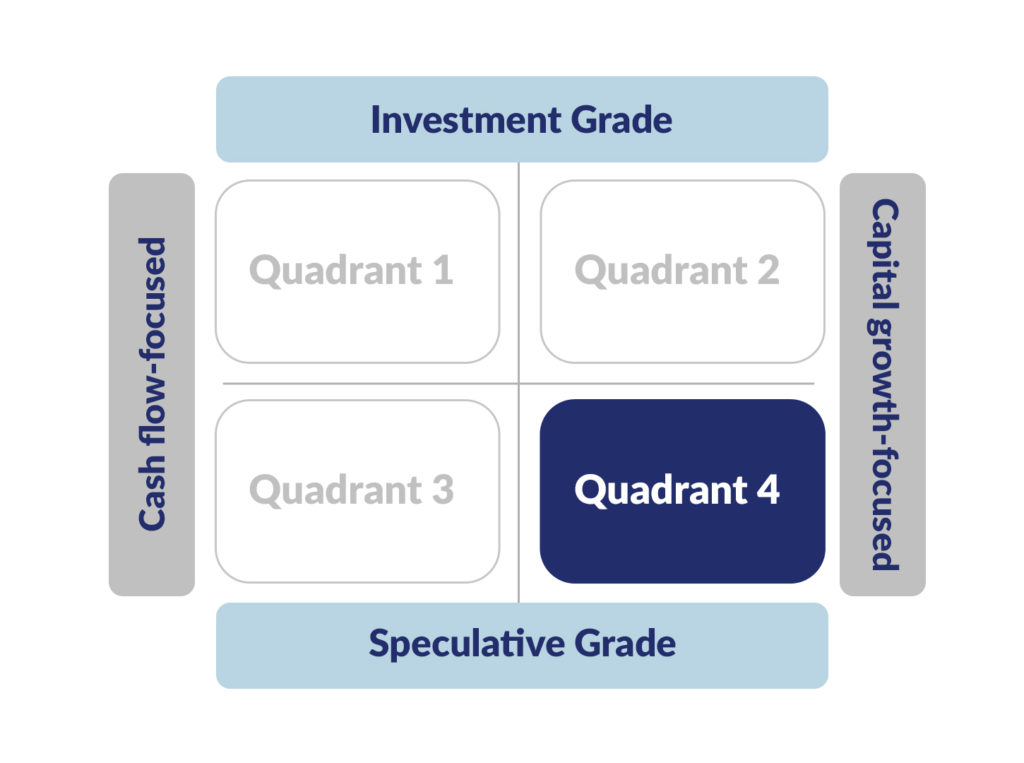

To get started, let us take a look at the quadrant first.

There are two important things to remember to better understand the investment quadrant.

First, the quadrant is split horizontally in two halves – we have the quadrants 1 and 2 on the upper half and the quadrants 3 and 4 on the lower half. Real estate investment deals that belong in the upper half of the quadrant are of investment grade, meaning, these deals are of low to moderate risk. On the other hand, deals that belong in the lower half are of speculative grade which are high risk deals.

Second, the quadrant is divided vertically into two sides – quadrants 1 and 3 on the left side and quadrants 2 and 4 on the right side. The left side of the quadrant are cash flow-focused investments. These are generally high income, low growth investments. On the other side are capital growth-focused investments and it is basically the opposite. In other words, these are low income, high growth investments.

Moving on.

How is the investment quadrant helpful?

The investment quadrant helps you look at different real estate investment deals objectively.

First, you will be able to see which quadrant a deal falls, helping you better understand the level of risk and reward you are taking.

Second, the quadrant gives you a clear picture which deals are better designed for cash flow and which ones are for growth, helping you determine the returns you get from investing.

Now, let us take a close look at each quadrant.

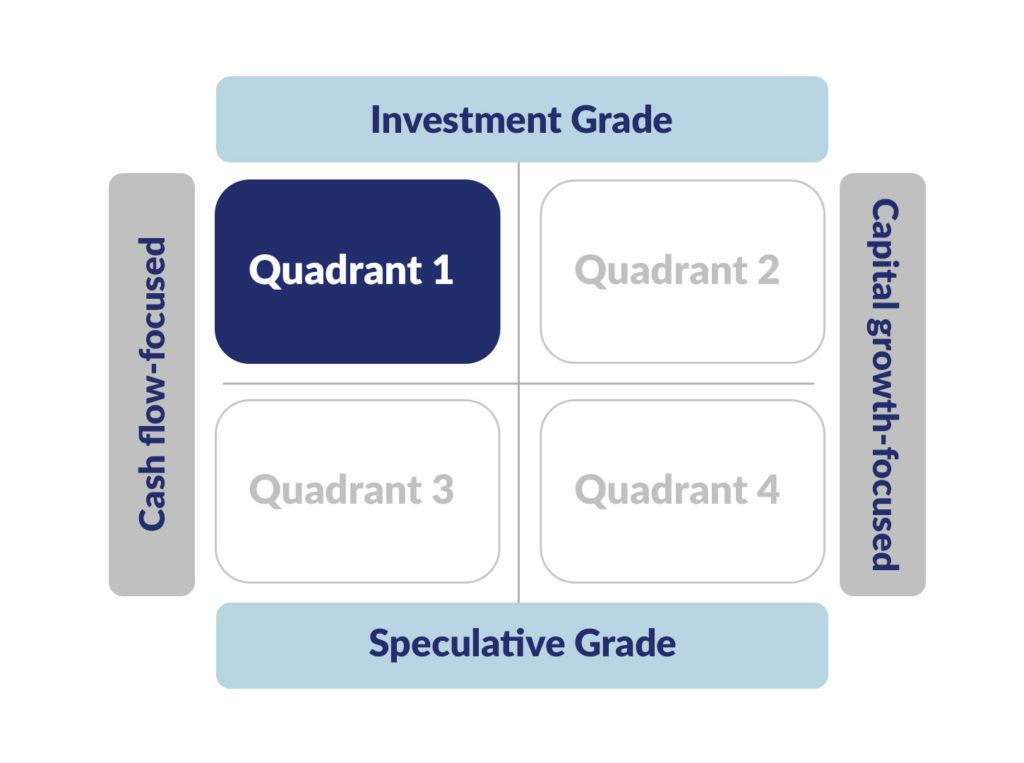

Quadrant 1: Investment grade, cash flow-focused deals

- Being an investment grade deal, it is generally low to moderate investment risk.

- It provides a positive income with good initial cash flow.

- Typically, the real estate deals that fall in this quadrant are such as first lien performing notes or commonly known as first lien mortgage notes as well as conservative leverage equity deals.

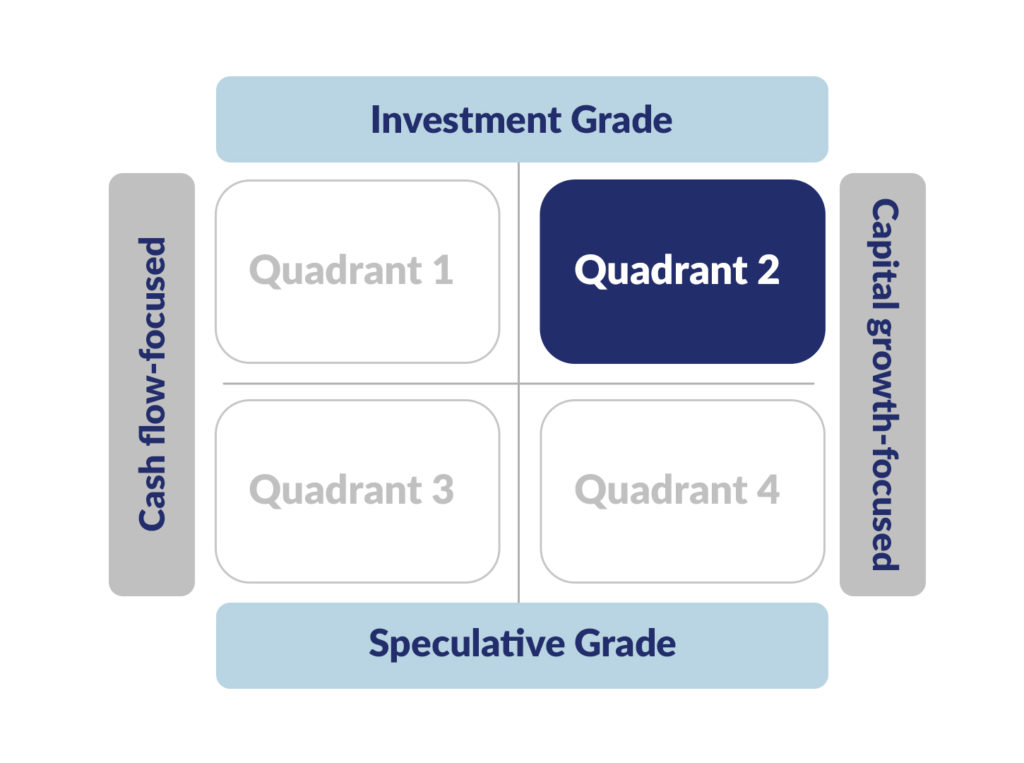

Quadrant 2: Investment grade, capital growth-focused deals

- Deals that belong in this quadrant low to moderate risk.

- They have no or limited cash flow at the start.

- For example, first lien non-performing notes and moderate leverage add-on projects.

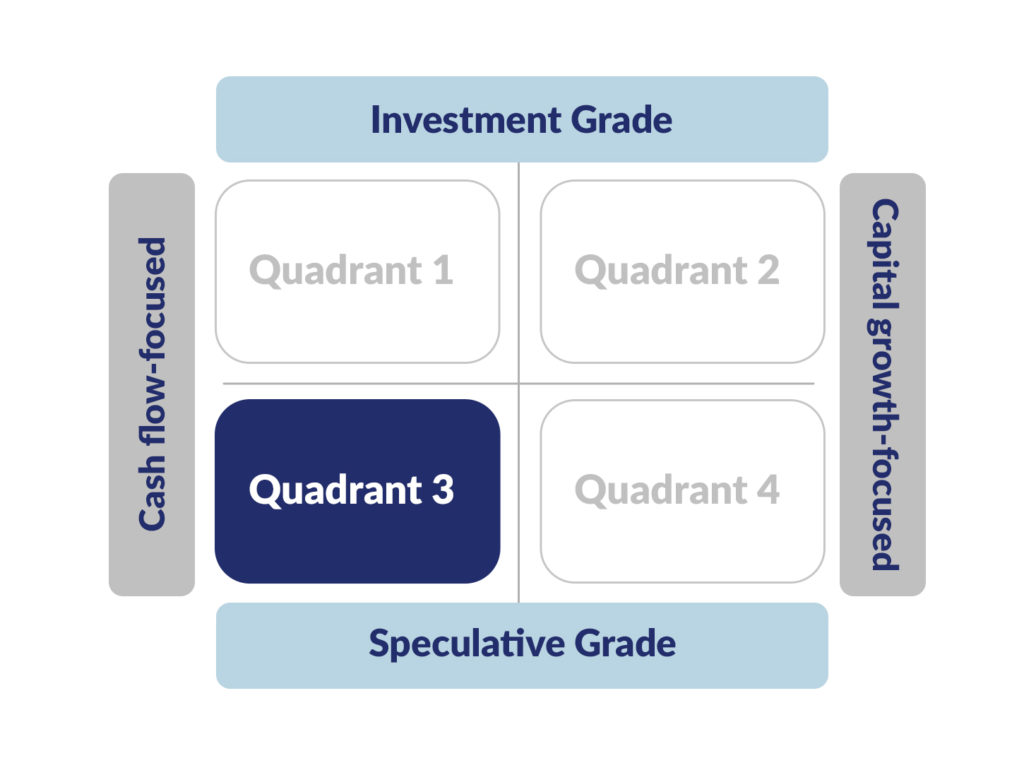

Quadrant 3: Speculative grade, cash flow-focused deals

- Being a speculative grade deal, you are now looking at investment deals with higher degree of risk compared to the previous quadrants.

- These deals have strong initial cash flow, generating an income.

- The example includes second lien performing notes or second lien mortgage notes as it is commonly called, in addition to highly leveraged equity deals.

Quadrant 4: Speculative grade, capital growth-focused deals

- These are also high risk investment deals.

- There is limited cash flow to start with.

- Real estate deals that belong in this quadrant include development, redevelopment, land speculation as well as heavy value-add projects.

Well, you might be asking…

Which quadrant is the best? Which one is the worst?

The answer is, quadrant 1 is neither good nor bad. Same thing goes for quadrants 2, 3 and 4. Each investment deal is different and the reason why this investment quadrant is helpful is that it gives you a better grasp which among the deals you have fits your financial goals and objectives.

Now, let us look at the investment quadrant and the risk adjusted return.

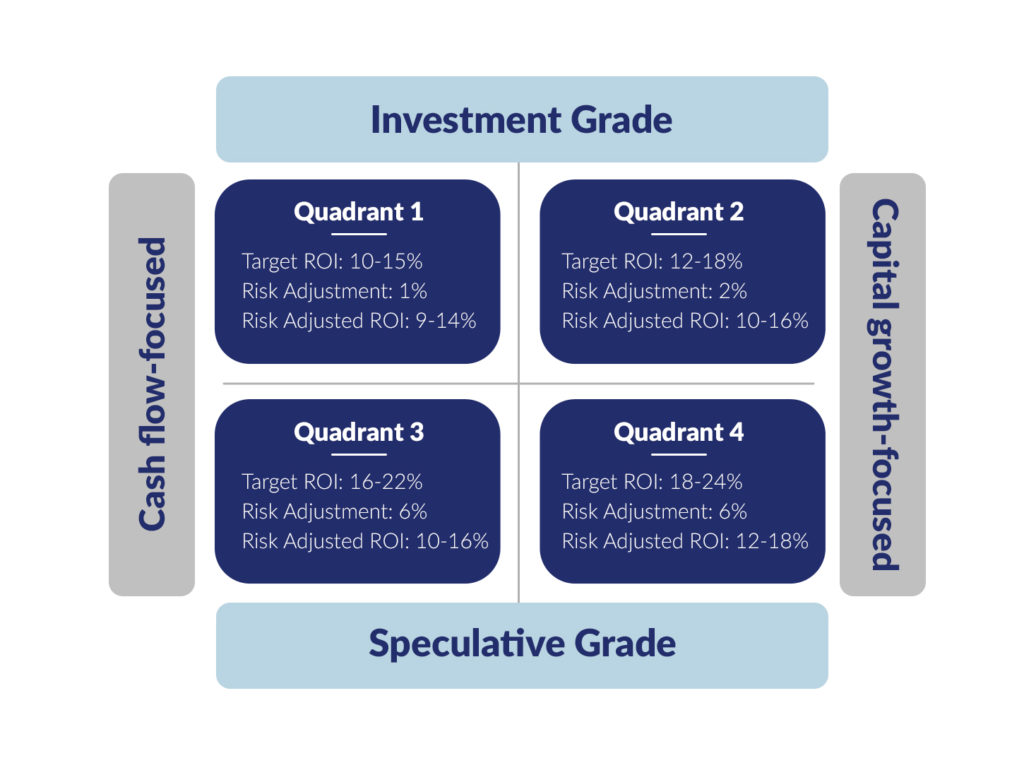

Please note that the numbers you see are examples only. The actual deals could have different characteristics and the returns could be lower or higher. This is only to illustrate the potential return of investment for each quadrant.

Let us say you get an opportunity to invest in a first lien mortgage note. This deal falls in quadrant 1, which means it is an investment grade, cash flow-focused deal. The note pays a 10 percent rate of return. The investment is not zero risk. Hence, you should adjust for risk and the risk adjustment for quadrant 1 is one percent. If you take a 10-percent note and you adjust for the risk associated with the investment, then the risk adjusted return is nine percent. The same approach applies to quadrants 2, 3 and 4.

The risk adjustments vary in each quadrant. As you move from the upper half (quadrants 1 and 2) to the lower half (quadrants 3 and 4), you take more investment risk. And as a result, you get higher risk adjusted compensation. Otherwise, why take risks? As the saying goes, “the greater the risk, the greater the reward.”

The same thing goes with the cash flow-focused versus the capital growth-focused deals, as you move from the left side (quadrants 1 and 3) to the right side (quadrants 2 and 4), you receive a higher adjusted risk return as a result of foregoing the cash flow. Otherwise, it does not make sense to take all the risk.

So, there you have it, the basic principles of investing.

I use this investment quadrant to help me better understand the risk and return of the different real estate deals I have on the table. I hope this quadrant helps you make better investment decisions.

Thank you for your time.

Looking forward to speaking again soon.

Mike