In the March Issue

- Investing vs. Speculation

- How to Identify Investment Grade Projects

- How to Identify Speculative Grade Projects

- Example of “Fair” and “Poor” Splits

In the February newsletter, we explored the inner workings of real estate funds and how fund managers like ourselves find and analyze deals coming through our door.

This month, we’re going to continue our conversation about deal analysis and take a look at the four main quadrants that most deals fall under. If you’re an investor looking to buy real estate or invest in a syndication, it’s important to understand a deal’s risk and whether or not it’s worth your money. The items we’ll discuss below will be a resource for you as you explore syndications and deals within the real estate space.

Investing Vs. Speculation

In order to understand the different levels of risk between investments, it’s important to identify the difference between investing and speculation.

*Definition: Speculation is a financial action that does not promise safety of the initial investment along with the return of the principal sum; typically a short run phenomenon

Many speculative investments present attractive opportunity with higher “advertised ROI”, yet they carry a significant degree of risk to the invested capital. Most of these investments have little to no cash flow compared to many development or re-development projects, whereas on the flip side, value investments typically have strong cash flow with limited downside.

Note: There are plenty of “investment grade” projects with low or no cash flow, and in contrast there are also “speculative grade” deals with strong cash flow. Cash flow by itself is not a good indicator of the investment safety. downside protection is what differentiates “Investment Grade” vs. “Speculative Grade” projects.

Benjamin Franklin once said “An investment is one which, on thorough analysis, promises safety of principal and a satisfactory return. Operation not meeting these requirements are speculative.”

When considering an investment, look through this lens: Is there a reasonable degree of safety to the principal and a satisfactory return? Depending on the current market conditions, your answer may be different, but it’s important to evaluate each project with risk in mind. Let’s take a look at four different investment quadrants most most deals fall into today.

Introduction to Investment Quadrants

When considering investing in a commercial syndication, whether it be a multi-family syndication, self-storage, retail, etc., it’s important to think about where the investment falls from a risk perspective.

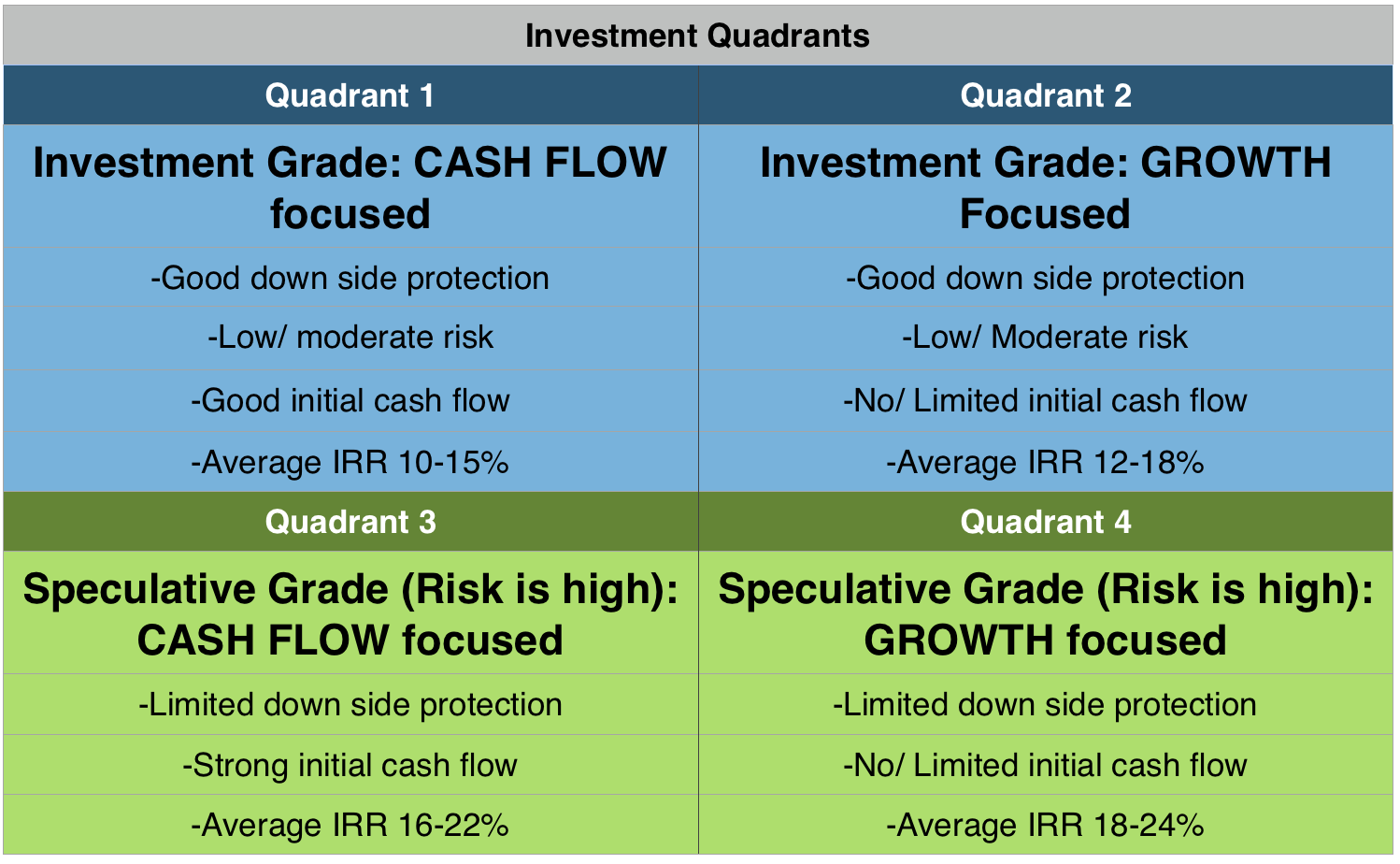

The four investment quadrants are divided between two main investment types: Investment Grade and Speculative Grade. With a foundational understanding of investing versus speculation, Investment Grade deals tend to have less risk but lower returns. Speculative Grade deals tend to be riskier projects but may have higher returns for investors. Take a look at the investment quadrants below:

Note: “Average IRR” in the image above is used as an example to show that lower risk projects have a bit lower projected IRR, and higher risk projects have a bit higher projected IRR. However, IRR may differ significantly by project, by sponsor, by asset type, by location, by market condition and so forth.

How to Identify Investment Grade Projects

Let’s start by breaking down investment grade deals and identifying the differences between quadrant 1 and quadrant 2.

Investment grade deals focused on cash flow will fall in this first quadrant. They usually have good down side protection, good initial cash flow and low to moderate risk. (When we say low to moderate risk, we are referring to fairly good downside protection, but all projects have a degree of risk.)

Investor Note: Regardless of the type of investment, there is always risk involved. A few examples of different types of risk include construction risk, local zoning/ government regulation risk, occupancy risk, insufficient capital risk, environmental risk, local/broad economy risk, Key Man risk, and natural disaster risk.

These “first quadrant” projects can generate good cash flow, anywhere from 7-12%+ annually, with some appreciate of 2-10%+. The first quadrants is typically referred to as the “safest” quadrant of the four.

A few examples of projects falling in this first category include funds like the Tempo Opportunity Fund LLC, other well diversified funds focused on cashflow investment grade projects, and stand along syndications with moderate leverage and light value-add in multi-family housing, self storage, retail space, first lien loans, and single family turn-key homes.

The second quadrant is very similar to the first in that it is also investment grade and offers good downside protection and low to moderate risk. The difference is that this quadrant is growth focused with very limited initial cash flow. The average IRR is slightly higher, hovering between 12-18%.

Examples of these type of projects include non-performing note syndications with good loan-to-value (below 60% LTV), heavy value adds projects in multi-family syndications, self-storage, office, and retail.

It’s important to note that Quadrant 1 and Quadrant 2 projects have strong down-side protection, may it be low LTV, strong cash flow that can survive a stress test, or low/moderate leverage. These projects should have a reasonable degree of safety of principal. There are no guarantees, but risk is generally lower on these types of projects vs. speculative grade ones.

How to Identify Speculative Grade Projects

The bottom half quadrants fall under what we call “speculative grade” deals. These investments typically have a higher degree of risk, stronger returns, and require a higher level of sophistication to manage these projects.

Like we mentioned before, it’s especially important to evaluate current market conditions before investing in speculative deals. In recent years, the economy has been booming, so most speculative deals have done really well. But as the market begins to level out and make a downward turn, these same speculative deals that have done really well in the past may start underperforming.

Similar to the investment grade quadrants, speculative grade projects are broken out into two types: cash flow focused and growth focused.

Investments that are cash flow focused (nearly 12-24% cash flow) will fall into quadrant three. These projects have limited downside protection, strong initial cash flow, and an average IRR of 16-22%.

A couple examples of quadrant three projects include heavily leveraged syndications and 2nd lien debt.

Many deals you might be familiar with fall into quadrant four. These deals include ground up constructions projects, re-development, and land speculation.

These projects have the highest degree of risk across the board with little to no cash flow up front. However, they have strong appreciation (18%+) and an average IRR of 18-24%. When it comes to investing in these types of projects, it all comes down to the project sponsor’s track record, individual project life-cycle plan, and your personal due diligence of evaluating current market conditions and knowing/ mitigating the risks involved.

Note: These projects might pencil very well, but many of them run into various delays, costs overruns, lease-up plans may not run as well as projected, and so forth. Rarely ever, these projects run smoothly per the initial plan.

Risk Adjusted ROI and Volatility of ROI

When you evaluate a deal, you need to make a plan first regarding how much capital you want to put into investment grade projects and speculative deals. Depending on your personal investment goals, you will evaluate each deal through this filter.

When you invest in a syndication, often times the sponsor will give you memorandums or documents that contain projected numbers. More often than not, these numbers are very optimistic, meaning, you should discount by the risk adjusted return factor in order to better gage a projected return. You might have to make an assumption and discount the advertised numbers with, per se, the level of risk.

*Investor Tip: If you want to increase the safety of your overall portfolio, allocate more of your money to investment grade deals.

It’s important to consider loss reserves when making investments in order to create a safety of margin for yourself. Each quadrant has the potential to underperform. For the investment grade quadrants, loss reserves are pretty low around 1-2%. For the speculative grade quadrants, loss reserves increases to nearly 6% due to their high volatility.

Quality Cash Flow Syndications and Similar Funds

If you want to invest in a multifamily, self-storage, retail, or office syndication, you want to carefully analyze their split structure to make sure you, as the investor, are getting the good end of the bargain.

A lot of syndications have terrible splits where they’ll give investors 10% of payments and the sponsor will receive the other 90%. For example, the split might look like a preferred return of 10% and then a 10/90 split on the back end. It creates a poor risk adjusted return.

If one of every ten deals go bad, you want to make sure your portfolio is diversified enough to compensate for the deals that go south. So if you get a terrible split on the syndications that do perform well, that 10% may not be enough to cover the bad deals.

![]()

Examples of “Fair” Equity Deals

Let’s take a look at some examples of “fair” splits for both the investor and sponsor…

-

Deal 1:

- Preferred Return: 8%

- Annual Asset Mgmt Fee: 1%

- Performance Split (above Pref): 70/30 (investor/ sponsor)

-

Deal 2:

- Preferred Return: 9%

- Annual Asset Mgmt Fee: 1%

- Performance Split (above Pref): 70/30 (Investor/ Sponsor)

-

Deal 3:

- Preferred Return: 0%

- Annual Asset Mgmt Fee: 0%

- Performance Split: 80/20 (Investor/ Sponsor)

-

Deal 4:

- Preferred Return: 24%

- Annual Asset Mgmt Fee: 1%

- Performance Split (Above pref): 25/75 (Investor/ Sponsor)

-

Deal 5:

- Preferred Return: 18%

- Annual Asset Mgmt Fee: 0%

- Performance Split: 30/70 (Investor/ Sponsor)

*Note: The last two deal examples balance low performance splits with high preferred returns. These combinations are generally reasonable.

Examples of “Not Fair” Deals:

Below are a couple examples of deals that do not favor the investor.

-

Deal 1:

- Preferred Return: 8-10%

- Annual Asset Mgmt Fee: 2%

- Asset Acquisition Fee: 4-6%

- Performance Split: 10/90 (Investor/ Sponsor)

-

Deal 2:

- Preferred Return: 6%

- Annual Asset Mgmt Fee: 2%

- Asset Acquisition Fee: 4-6%

- Performance Split: 50/50 (Investor/ Sponsor)

*Note: Some sponsors will charge heavy up front fees, so it’s important to clearly ask what fees they require from day one.

As you can see, there is a lot of due diligence that should take place when deciding to invest, but these are a few tools and resources to help you make the best decision for your investment portfolio.

Wrap-Up

When you understand the right questions to ask when deciding to invest your money in a syndication, it will be a lot easier to decipher which sponsor to invest with.

At TF Management Group LLC, we have our own fund called the Tempo Opportunity Fund LLC that is a passive option for accredited investors looking to diversify their portfolio without doing the heavy lifting of investing in individual deals. We focus on investment grade deals to provide a hedge of protection again volatile market conditions. While no return is ever guaranteed, regardless of the type of investment, we do our due diligence by investing with sponsors we know and trust.

To learn more about the Tempo Opportunity Fund LLC and how we structure our preferred returns and splits, visit https://tempofunding.com/investors/ or Contact us and I will happily walk you through the fund structure.

Thanks for reading!

Mike Zlotnik

CEO, TF Management Group LLC

This newsletter and its contents are not an attempt to sell securities, nor to sell anything at all, nor provide legal, nor tax accounting, nor any other advice. The presenter is a private lending and real estate fund management business, and the information represented herein are purely for educational purposes and represents the opinions of the presented. Prior to making any investment or legal decision you should seek professional opinions from a licensed attorney, and a financial advisor.

TF Management Group LLC (TFMG) is an investment fund management company that specializes in both short-term debt financing for real estate “fix and flip” projects, and long-term “value-add” equity deals.