The real estate market operates in cycles, experiencing periods of growth and decline. These cycles can vary in duration and intensity across different markets. This article aims to provide a comprehensive understanding of the four main stages of the real estate cycle and highlight additional factors that influence these stages.

Moreover, we will explore various strategies that investors can employ within each phase to capitalize on the opportunities presented. At the end, I will discuss the phase we are currently in and how it has affected the commercial real estate market.

Recovery Phase

The recovery phase marks the beginning of the real estate cycle. During this stage, home prices start to rise, while inventory levels remain relatively high. Buyers have a broader range of options, and they can often negotiate favorable prices. The recovery phase is often characterized by low interest rates, increased job growth, rising consumer confidence, and a growing demand for housing. In this phase, investors can consider the following strategies:

- Buy-and-Hold: Investors can acquire properties at relatively lower prices and hold onto them for long-term appreciation. Rental income can provide a steady cash flow while waiting for the market to further improve.

- Value-Add: Identify properties in need of renovation or upgrades. By improving the property’s condition, investors can increase its value and potentially generate higher returns when selling or renting it out.

- Opportunistic Buying: Look for distressed or foreclosed properties available at discounted prices. These properties may require more effort to rehabilitate, but they offer potential for significant gains when the market rebounds.

Expansion Phase

The expansion phase represents the middle stage of the cycle. Home prices rise rapidly, and there is a shortage of available inventory. Buyers face increased competition, leading to prices often exceeding asking prices.

The expansion phase is often characterized by rising interest rates, robust economic growth, continued job growth, and a sustained demand for housing. In this phase, investors can consider the following strategies:

- Quick Flips: Purchase properties below market value, make minimal improvements, and sell them quickly for a profit. This strategy takes advantage of rising prices and strong demand, allowing investors to capitalize on short-term gains.

- Development Projects: Consider investing in new construction or redevelopment projects to meet the increasing demand for housing. This strategy requires thorough market analysis and feasibility studies to ensure a profitable outcome.

- Rental Investments: With rising prices and limited inventory, acquiring rental properties can provide a consistent income stream. Conduct thorough rental market analysis to ensure favorable cash flow and consider long-term appreciation potential.

Hyper-supply Phase

The hyper-supply phase occurs in the late stage of the cycle. Home prices begin to decline, and an oversupply of inventory emerges. Buyers have an abundance of options, which enables them to negotiate more favorable prices. The hyper-supply phase is often characterized by rising interest rates, slowing economic growth, job losses, and a decreased demand for housing. In this phase, investors can consider the following strategies:

- Value Buying: Identify distressed properties with motivated sellers who need to sell quickly. Negotiate favorable prices, potentially below market value, and focus on properties with strong potential for improvement or alternative uses.

- Rental Stabilization: Shift focus to stabilizing existing rental properties rather than acquiring new ones. Optimize property management, tenant retention, and cost management to maintain profitability during the downturn.

- Diversification: Consider diversifying investments beyond traditional residential properties. Explore opportunities in commercial real estate, mixed-use properties, or alternative real estate assets to mitigate risks associated with oversupply in the residential market.

Recession Phase

The recession phase represents the end of the real estate cycle. During this stage, home prices experience rapid declines, and there is an excess of available inventory. Buyers become scarce, resulting in prices often falling below the asking price. The recession phase is often characterized by high unemployment rates, falling consumer confidence, and a decreased demand for housing. In this phase, investors can consider the following strategies:

- Cash Positioning: Preserve liquidity and maintain a strong cash position to take advantage of distressed opportunities that arise during the downturn. Be prepared to act quickly when favorable deals become available.

- Distressed Property Investing: Look for distressed properties, including foreclosures, short sales, or properties facing financial distress. These properties can be acquired at significant discounts and offer potential for substantial gains during the recovery phase.

- Opportunistic Investments: Consider alternative real estate investment opportunities, such as distressed debt investing or real estate investment trusts (REITs), that can provide exposure to real estate while mitigating some of the risks associated with direct property ownership.

Understanding the four stages of the real estate cycle—recovery, expansion, hyper-supply, and recession—provides valuable insights for investors to make informed decisions about buying and selling properties. However, it’s important to note that these stages can vary in duration and intensity, depending on market conditions and external factors.

Additionally, considering economic conditions, interest rates, government policies, and demographic shifts allows investors to gain a more comprehensive understanding of the real estate market and make better investment decisions.

It’s crucial for investors to adapt their strategies to each phase of the real estate cycle. Whether it’s buying and holding properties, adding value through renovations, seizing opportunities during expansions, or identifying distressed properties during downturns, a tailored approach is essential for success.

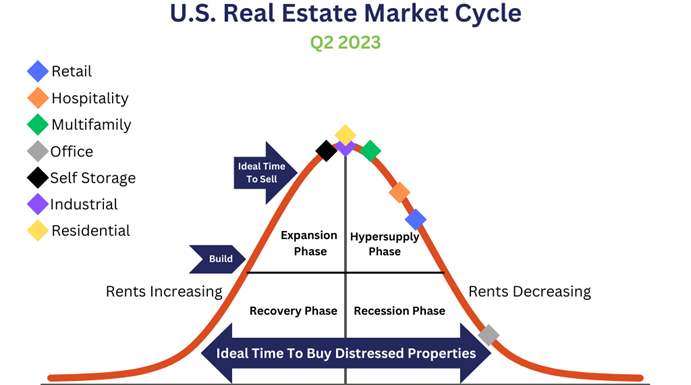

Although we have explained a classic real estate market cycle, right now we are in a strange market adjustment period, with supply being very short. We are not in the hyper-supply phase yet because supply is very limited:

- Sellers don’t want to sell because they have locked low interest rate mortgages and have no pressure to sell for many years.

- New construction is lagging too with higher interest rates.

- Demand is softened with a higher interest rate environment.

- Affordability is very low due to high interest rates and limited supply (sellers not discounting much).

- Foreclosures are very low and there is very little distressed inventory.

- Unemployment is at historically low levels, so people still have income to pay mortgages.

In my opinion, we are somewhere at the end of the expansion phase, moving towards the beginning of the hyper-supply, but it is not a normal/classic cycle. We are dealing with a very dislocated, strange cycle that the world hasn’t seen before.

Theoretically, we’ve met a few requirements of the hyper-supply phase: “The hyper-supply phase is often characterized by rising interest rates, slowing economic growth…” Maybe it is the start of hyper-supply in a weird way. On the commercial side, things really depend on the asset class and location. Office is already in a recession phase as COVID massively destabilized the demand for that sector.

Multifamily housing is in very short supply and it is likely to be somewhere at the end of the expansion phase, the beginning of the hyper-supply too… Some distressed seller situations are beginning to surface mostly due to the maturing loans/rate CAP expiration, and poorly executed value-add plans.

Self-storage still appears to be in the expansion phase (late in that phase) and may be starting to move into the hyper-supply phase. Hospitality is still doing well, but there are future concerns that the consumer has taken on a lot of debt and will be running out of buying power.

Retail is a special category, it is important to differentiate between indoor malls and open-air shopping plazas. Indoor malls were strongly affected by COVID. However, outdoor shopping plazas have proven to have unique advantages with strong resilience in the face of COVID and though e-commerce disruptions. The open-air shopping plazas benefit from limited supply with not many new builds and high demand from high-quality, long-term tenants like dental and medical offices, grocers, restaurants, and entertainment venues, as well as retailers that do better in person than online.

The times are unprecedented as we’ve never seen interest rates spiking from zero FED funds rate to 5-5.25% range in 1 year. This is a lot of uncertainty about how much damage it’ll cause and how fast. The fear is that we might fall fast into the recession phase, without spending much time in hypersupply.

We are certainly entering a later part of the real estate investment cycle, but it is not a normal cycle. Classic models don’t appear to work well in this environment. Society is writing the history of the “post-pandemic economic cycle” now, combining that with the interest rate spiking rapidly to fight inflation and the U.S. economy that has been addicted to the low interest rates for a long time.

Unemployment is at historically low levels, and that makes it difficult to see a severe recession ahead unless a massive number of layoffs start taking place. We certainly can conclude that the economic growth is slowing and we are likely to hit a technical recession (2 negative quarters of GDP) in late 2023 and into 2024. The rest we have to observe and respond dynamically.

In many markets, residential real estate hasn’t come down in pricing because the supply is very limited now. Many existing 1-4 doors (Single Family residential, Duplex, Triplex, Quadplex) residential property owners have financed or refinanced their mortgage with the fixed rate 30 year debt with rates of 4% of below.

That fixed rate debt is a very valuable asset and people simply don’t want to sell as new purchases face much higher interest rate debt options. New construction has been lagging as well due to the higher interest rate environment and supply chain disruptions (it is now much more expensive for the buildings to finance construction). As a result the overall supply is just very low on historic levels.

On the demand side, higher interest rates make it difficult for the buyers to afford to buy, either primary residence or an investment property. Buyers are forced to put more cash down, and get a lower leverage mortgage to be able to afford debt service coverage ratio (“DSCR”) in case of the investment property, or debt to income (“DTI”) ratio in case of owner occupied properties. One recent new development that we’ve seen is that the banks are beginning to offer an attractive “buy down interest rate” option, e.g. requiring 6 points paid upfront to lower interest rates by 2%/year. This is signaling that banks expect interest rates to cycle back down in the next few years.

Overall, cash-on-cash return on equity investment in the residential properties is at the very low level on a relative basis. Why?

- Prices haven’t fallen much

- Interest rates are high

- Rent growth has slowed down and in some markets reversed

Forward return projections on the residential investments are not very attractive today because there hasn’t been a price correction, yields are very low and rent growth has slowed down. The investment today would have to be a long term investment in order to be worth a consideration.

Now let’s consider the commercial real estate state of the market. Higher Interest rates are generating massive pressure points on the owners that bought properties with variable rate bridge loans. Prudent owners bought rate CAPs (an insurance policy that started to pay them when interest rates went up) and have at least a temporary protection (typically 2-3 years). Transaction volume is down massively, 70-75%, from a year ago, as the “bid” and the “ask” have widened. Buyers are looking for the great deals expecting pressure on sellers to generate distressed sales transactions. Sellers are not yet giving up unless they are facing loan term maturity default or cannot raise sufficient capital to complete a “cash in” refinancing.

For opportunistic investors, this presents an avenue to acquire distressed properties or debt at discounted prices, providing the potential for outstanding returns in the future. We are always looking for great distressed value-add investment opportunities and expect to see more in the near future.

- Don’t listen to predictions, nobody really knows the future.

- “Know thyself” & your portfolio.

- Be prepared to act when you see strong opportunities.

- Invest in what you understand and avoid “bright and shiny” objects.

- Diversify, diversify, diversify, and be patient.

Stay tuned for more great opportunities, phenomenal deals that should generate great strong risk adjusted returns.

Big Mike

PS: We welcome your suggestions and questions, send them to Invest@TempoFunding.com or schedule a call at TempoFunding.com/IRcall.