In the May Issue

- Introduction to Risk Adjusted Return

- How to Compute Risk Adjusted Return

- Factors Influencing Loss Reserves

Introduction to Risk-Adjusted Return

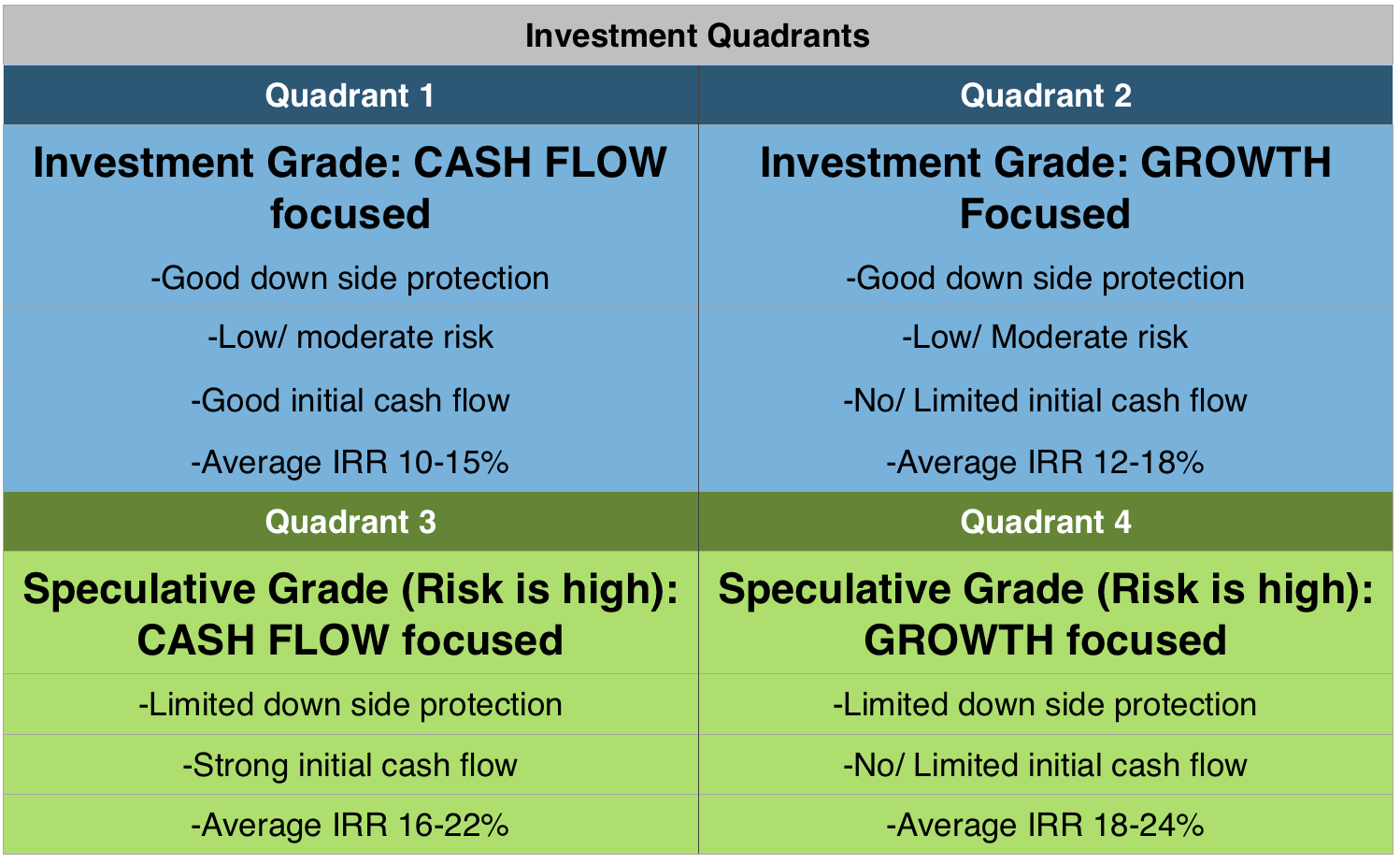

In recent newsletters, we’ve defined and discussed the difference between Investment Grade and Speculative Grade investment funds, delving into the characteristics of the investment quadrant and the four “groupings” of investment projects within a fund.

This month, we’ll expand upon some of those concepts as we articulate the necessity of understanding risk-adjusted return and how market conditions can impact both risk and reserves as investors consider entering into a deal.

Why You Should Care About Risk-Adjusted Return

Grasping risk-adjusted return (RAR) is an absolute necessity if you’re considering investing in commercial or individual deals, individual properties, funds, or alternative investments.

*Definition: Risk-adjusted return is estimating the true return on a given project. It’s necessary to decide what reserves to allocate on a given project to (essentially) compensate you for the risk. In essence, these reserves end up offsetting the risk.

This concept is a powerful one because instead of looking at the top line number promised to you, in actuality, you’re focusing on the bottom-line number likely to be the real return. Even though the offering memorandum may have numbers that look great at first glance–say 20%-25%–you have to take into consideration whether the project fits your portfolio and whether it’s a high-risk project.

*Investor Tip: If it doesn’t fit your philosophy, don’t do it. If the number looks too good to be true, it probably is. Never invest in a project just because the private placement or offering memorandum promises greater returns.

Investment Quadrants: A Key To Risk-Adjusted Return

In order to compute risk-adjusted return, a clear understanding of the nature of the investment being made is crucial. Is it a high or low risk investment? Do you have a good downside protection or not? We addressed the investment quadrant in our March newsletter, but as a refresher, the chart below outlines the difference in risk between the various quadrants.

In investment grade projects, either the likelihood of risk is lower, the impact is lower, or the combination of the two is lower. On more speculative based projects, the likelihood of risk combined with impact is higher.

Possible risks one might encounter range from risks in construction, local zoning, government, occupants, insufficient capital, environmental, and local/broad economy conditions, to shortage or lack of capital, lack of liquidity, pro forma projected financials, national election results, and natural disasters.

It’s not an easy task to come up with an exact formula for each risk, but you can understand conceptually what a risk entails and the likelihood or impact of it. Remember: never stray far from the reality that there are no guarantees.

Computing risk-adjusted returns

The formula for computing risk-adjusted returns is simple and straightforward. Risk-adjusted return equals the projected return, or in other words, what the project sponsors, fund managers, real estate brokers promote. Once you know the projected return you need to adjust it down by a loss reserve, a simple mathematical concept that adjusts whether there is risk on any given project or investment.

To understand how much risk reserve you need or how to compute RAR, you’ll need to consider the following concepts: capital stack, loan to value ratio (LTV), project sponsor, and cap rate. Let’s look at how each of these play a part in the risk-adjusted return.

- Capital Stack

- Loan to Value Ratio

- Project Sponsor

- Market Conditions

First, it’s important to consider the capital stack over a given project. Why capital stack? If you’re investing in a low-risk senior debt-type first lien mortgage on a property, your level of risk is fairly low because you’re in a more senior position on the capital stack versus junior debt, second lien loans, preferred equity, or corporate debt.

When the risk is high, the return potential needs to be high in order to compensate commensurately.

Next, it’s important to look at the value of equity behind you. For example, if you invest in the senior debt, and you’re at 65% LTV ratio and the project is stable, the risk if fairly low (you have 35% equity behind you which puts you in a strong position).

If you invest with an experienced operator with integrity and a solid track record, they can take equity capital and generate a strong return even in cases where the risk of the equity investment is higher than the debt. Operator experience compensates for that higher level of risk. A quality sponsor makes a tremendous difference in terms of how the project is run and how risks are met.

Market conditions, the current economic cycle, and where one expects the cycle to be when the project is complete are critical factors as well. Some key questions to consider: What kind of projects are you investing in? For example, is it a high-end apartment complex or condominiums? Is it situated in a more affordable range? Do you anticipate the possibility of an economic downturn or recession?

And finally, how will your project be perceived by the marketplace when it comes to completion? These questions will help determine the risk factor for a project.

When Computing Loss Reserves, Put it Through the Stress Test

So, how does one compute loss reserves? An understanding of this helps to mitigate some of the potential risks of investing. The number one concept here is called the stress test which, in real estate (or for any business for that matter), involves playing with a few key inputs or variables that could impact a potential project.

Let’s say you’re looking at either a new multi-family project, a new self-storage project, or new ground up construction. The stress test involves looking at the projected numbers and basically putting them under tremendous scrutiny.

You might, for example, reduce the occupancy by 10%. If a project sponsor in their offering documents says they expect the occupancy to be at 95%, stress it out and cut it to 85% in order to see what happens.

Clearly, this will not only impact cashflow–which is exactly what we’re trying to understand–but we might also assume that expenses will rise by 10%. We can then try to determine how the project will hold up under this type of stress.

You might ask, “Can it break even?” “Can it stay afloat in the midst of this type of circumstance?” Many of these projects assume that the capitalization rate–the rate of return on an investment–will be the cap rates of tomorrow or the future. This is far from certain. One of the primary risks when market conditions change is that cap rates will get worse; they’ll go higher (which is called cap rate expansion), and this, then, becomes a market sentiment.

Example: Multi-family Project

For example, if a multifamily building today in a given city is trading at a 5.5% cap rate, when the sentiment changes, that same building (all things being equal could be trading at 1% cap rate highs) could be trading at 6.5%. The difference between 5.5% and 6.5% cap rate is massive. It could be an almost 16-18% difference in price.

A $10 million building will be trading for $8 million (or a $100 million dollar building will be trading for $80 million). That much difference occurs when the cap rate expansion occurs. A 1% shift in the cap rate could result in a major change in the price of the asset.

Back to the stress test: what this means is that the exit price in all of these projects may not be what the sponsors are projecting. If the cap rate is projected to be 6%, increase it to 7%, so that you have a clear picture of what it will look like.

I’ve looked at some projects where we’re computing the cap rate at 6%, and the projected IRR was around 19% which is solid. If you increase the cap rate to 7% in the same project, the IRR will drop 4% to 15%, a significant drop.

This is your RAR computation. If you feel that the cap rate is going to be high, even by 1% by the time you go to market, well, that’s your risk-adjusted computation. You’re dropping the target rate of return by 4%. So you now no longer are in 19% range, you’re at 15% range.

Debt Service Coverage Ratio

Another concept to consider when determining the risk-adjusted return is the debt service ratio.

*Definition: DSCR is a mathematical formula which measures cash flow available to pay current debt obligations. The ratio states net operating income as a multiple of debt obligations due within one year, including interest, principal, sinking-fund and lease payments, attorney fees, taxes, and insurance.

Generally, banks require a debt service coverage ratio of approximately 1.2% to 1.25%, but a good, healthy ratio for investors is 1.5% which gives you some wiggle room as an equity investor. Lightly leveraged projects have the higher DSCR while higher leveraged projects barely meet the lower rate.

*Investor Tip: You don’t need higher loss reserves in investment grade situations. These projects should absolutely be able to withstand reasonable stress conditions. Loss reserves for investment grade projects should be between 1% and 2%.

Speculative projects, on the other hand, need high loss reserves, starting, typically, at no less than 5%. Some projects, if you truly allocate their loss reserve, have a negative risk-adjusted return.

As an investor in speculative projects, you have to set aside for high loss reserves in your mind. The standard number I use is 6% to 7%, but if market conditions change, this number has to be raised.

Wrap-Up

To recap, as we said at the outset, there are very few guarantees in life, but in the investment world you can count on risk being omnipresent. Due to the fact that sponsors, promoters, OMs and PPMs never acknowledge Risk-Adjusted Return, it’s incumbent upon you, the individual investor, to take into account a variety of factors that could dramatically impact your return rate. It’s up to you to decide what reserves to allocate to a specific project and how to compensate yourself for the risk.

If you would like to learn more about how we’ve estimated Risk-Adjusted Return in some of our investment deals and how we’ve adjusted our return expectations to accommodate the risks outlined above, please contact us and I will be pleased to answer your questions and concerns.

Thanks for reading!

Mike Zlotnik

CEO, TF Management Group LLC

This newsletter and its contents are not an attempt to sell securities, nor to sell anything at all, nor provide legal, nor tax accounting, nor any other advice. The presenter is a private lending and real estate fund management business, and the information represented herein are purely for educational purposes and represents the opinions of the presented. Prior to making any investment or legal decision you should seek professional opinions from a licensed attorney, and a financial advisor.

TF Management Group LLC (TFMG) is an investment fund management company that specializes in both short-term debt financing for real estate “fix and flip” projects, and long-term “value-add” equity deals.