In the May Issue

- Why Diversify?

- Diversified Portfolio Building Blocks

- Tempo Growth Fund LLC

Part 2: Coronavirus Impact on Investing: Where Do We Go from Here?

In last month’s newsletter, we discussed how the coronavirus is impacting the economy and real estate, and possible market outcomes in the weeks ahead. We also talked about ways to safeguard your wealth during this volatile time.

This month, we are going to deep dive into the benefits of diversification and what that can look like for your investment portfolio.

Why Diversify?

If we use the Brooklyn Cyclone roller coaster as a metaphor for the stock market, that’s pretty much where we are today. The Stock market has shown significant positive moves in the last couple of weeks, but it might turn around and have another significant run down. Volatility is still high, even though the initial “great fear” subsided. Some people may enjoy the ups and downs of the volatile market, but I would rather take smooth sailing and predictability of a diversified portfolio in real estate.

Knowing this, the question to ask is “Is this something that I enjoy day in day out or would I rather have smooth sailing?” If you prefer the latter, that’s a good reason to diversify your portfolio in order to avoid these extreme vacillations.

Diversified Portfolio Building Blocks

In well-diversified funds, individual deals, syndications, partnerships or direct ownership are the foundational blocks of your portfolio. Once you’ve built a sound base in regards to a well-diversified fund, you can start to add more individual deals, syndications, partnerships, or direct ownership to your portfolio.

Generally speaking, funds are the simplest and easiest way to diversify and then you can pick and choose among the other categories.

Your Capital Allocation: You Need to Decide

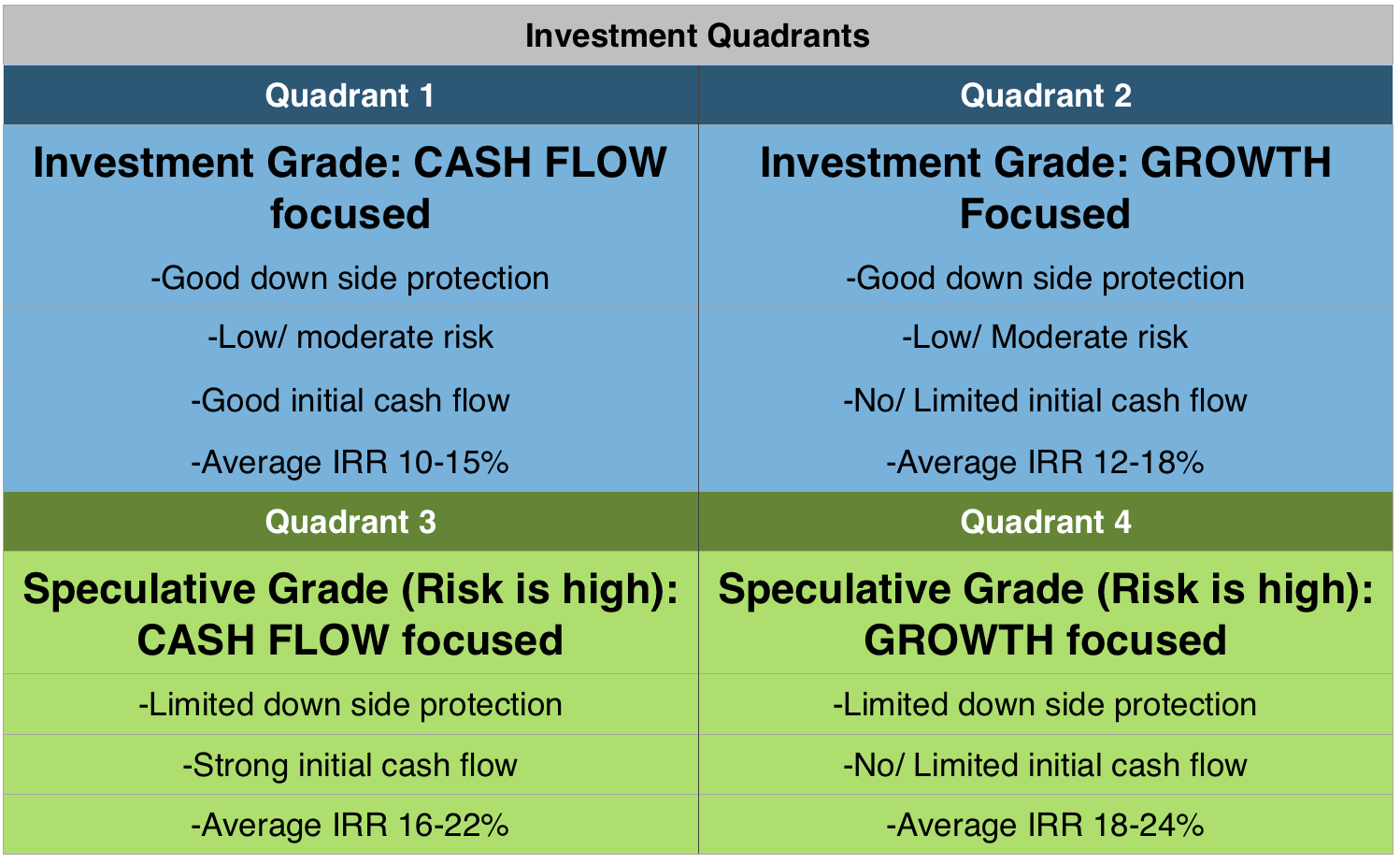

When we consider capital allocation, we need to return to the quadrants. In essence, the quadrants provide a great source for us to think clearly and specifically about what we want to do with our money. Simply put, it’s an educational concept.

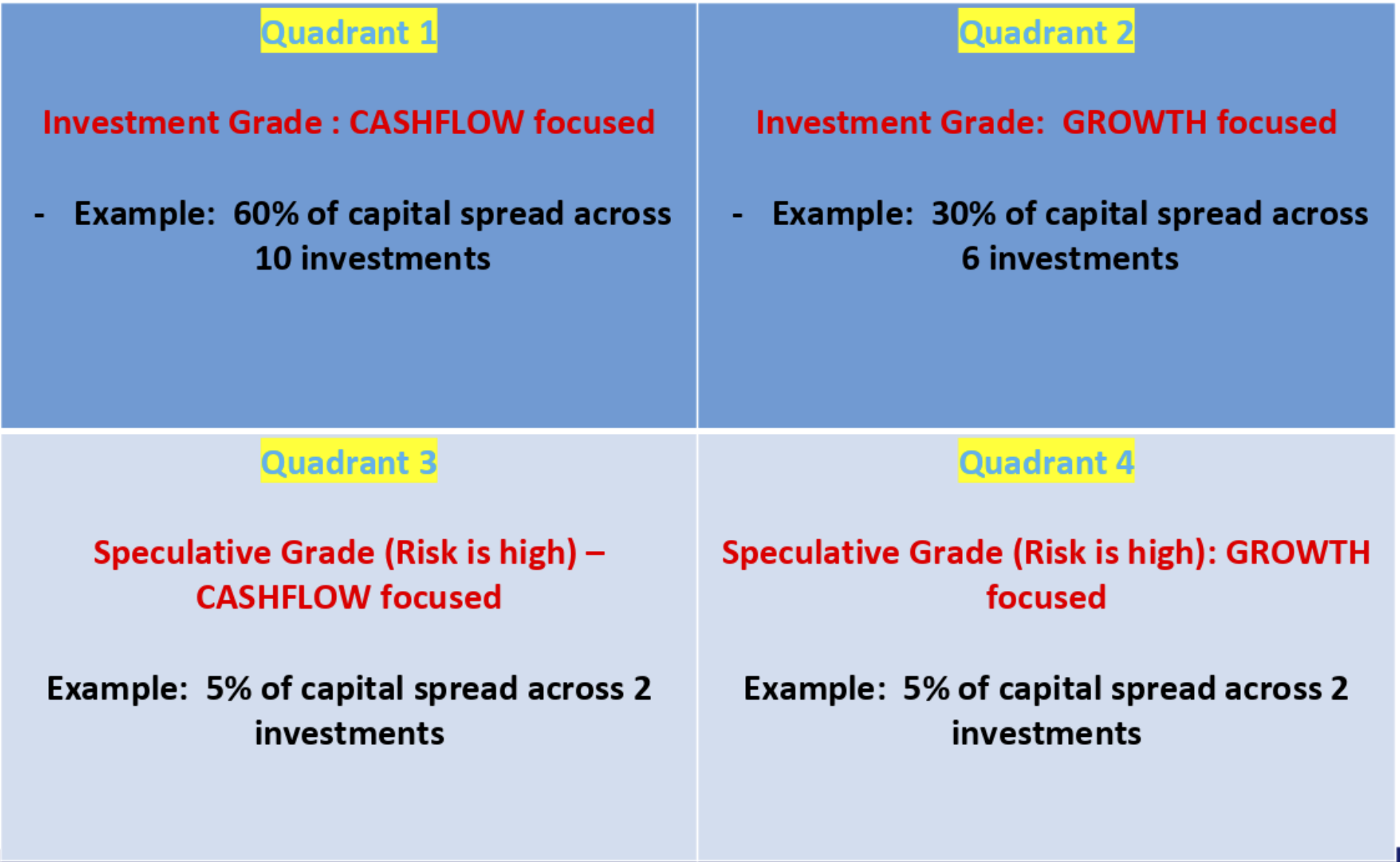

If you’re not comfortable with risk, then you’re probably not comfortable with the market. If that’s the case, then you most likely want to consider quadrant one investments; these are cash flowing deals with good downside protection. You may determine you want 60-70% of your portfolio there. Then it becomes a matter of finding deals in that quadrant to deploy your portfolio.

If you’ve made a decision to put 60% of your portfolio in quadrant one, just be patient. Having cash on hand is certainly not a bad thing and allows you to wait for the right deals to take advantage of them.

In terms of building a specific goal, you can put 60% in quadrant one and 30% in quadrant two which is a fairly defensive quadrant. It includes distressed commercial debt where you’re a first-lien mortgage holder with great collateral. Granted, you’re not getting cash flow today, but you are foreclosing on a property in a strong position. Again, this is a defensive investment. There are strong reserves, and it’s not losing money.

There are numerous opportunities in quadrant two that don’t generate cash; they have good efficiency with very strong, defensive characteristics. Again, if you’re market shy, then quadrants one and two may well be for you.

On the other hand, you can still allocate in quadrants three and four, although in this current market, I’m not a big fan of them. On occasion, good deals will come forward with people you know and the deal makes sense. It might make sense to have some allocation in quadrant four–say 5%–because the majority of deals (8 of 10 for example) that come across your desk may be in that quadrant.

If you decide to pick four of the eight, that could be a mistake because it’s inconsistent with your established goals.

That’s why it’s critical to establish goals first, followed by capital allocation and how much you should be placing in each quadrant.

*Note: COVID-19 has impacted real estate too.Even defensive real estate has taken a few “punches in the stomach”.The virus disproportionately impacted Hospitality and Retail assets, and only the time will show how well they will recover.We are looking at the significant upcoming opportunities as a result of COVID-19, but they are likely going to take 90-180 days to come forward, when the distress pain is significant.

Defensive Investments for Growth, Income and Growth

Here are a couple of examples of funds that give you an opportunity to enter into the world of diversification with a focus on quadrants one and two.

Tempo Growth Fund LLC is primarily quadrant two based with some focus in quadrant four while Tempo Opportunity Fund LLC is strongly focused on quadrant one (with some investments in two, three, and four).

In terms of our business philosophy, it’s very much based on the model established by Warren Buffett who puts emphasis on selecting the right people with whom to invest. Like Buffett, we always start with people whom we trust (our sponsors and fund managers). Our philosophy is based on the idea that your network equals your net worth.

All of our deals come through relationships. We don’t do any deals with people whom we don’t know, don’t like, or we don’t trust. In fact, all things have to match. We have to know, like, and trust people and we have to know the provenance of a deal.

Second, we work hard to select projects in keeping with the goals of the allocation model. Then, we determine how much to invest. We look at how it fits into the overall diversification strategy. We certainly think about diversification all the time, trying to diversify among many dimensions, equity deals, debt deals, locations deals, types, sponsors, and so on.

Tempo Growth Fund LLC

Tempo Growth Fund LLC is a brand-new fund that launched January 1st. It’s growth-focused with emphasis mainly on quadrant two deals.

As stated above, we are opportunistically taking advantage of some quadrant four deals essentially because some of the deals are borderline quadrant two and four. There is some degree of risk associated with this decision, but we feel strongly about these deals. In keeping with our aforementioned philosophy, we do the best we can to select the best deals with the best risk adjusted return.

Furthermore, it’s a close-ended fund with a target ROI of 12 to 18% and a five to seven-year term. We plan to raise capital for 12 months (with the possibility of two six months extensions). Once we’ve reached $25 million or 24 months, it expires. From this point, we will not raise any more capital, and we’ll complete the investments and then run them, generally speaking from three to five years (or, if possible, seven).

It’s higher because we are not providing cash flow. That’s the bottom line: you’re sacrificing cash flow. If you don’t have an upside of higher return, why forego the cash flow? Why even consider investing for growth if you are not going to get the target return?

Therefore, this fund has a higher target. It is also tax efficient, and a good amount of depreciation will pass through to investors as part of the tax efficiency.

Areas of Investment

Our areas of investment include distressed commercial real estate and value-add investments such as multi-family units and self-storage. We also tend to favor other opportunistic projects in the right type of areas.

The fund is characterized by a very professional, almost institutional level waterfall. It includes an 8% deferred return to investors, cumulative, non-compounded return.

The fund has two classes of units:

- Class A – (80/20) ($1,000,000 +) in which investors get 80% and managers get 20% performance fee

- Class B – (70/30) ($250,000-$999,999)

Part of our philosophy is investors come first. All of our funds are designed to give investors strong, preferred returns at a professional level waterfall, like the 80/20 split, in class A units.

Tempo Opportunity Fund LLC

Tempo Opportunity Fund LLC, an income and growth fund, has been around for approximately three years. The fund, which is open-ended (evergreen), has grown steadily, and, as of January 1st, the capital in the fund is in the $20.5 – $21 million range.

We deliver strong returns to our investors. Approximately two-thirds of the total return comes in the form of income while the other third comes in the form of growth. The target ROI is 10-13%. We have no leverage at the fund level which basically helps IRAs avoid UBIT.

Our main areas of focus are hard money loans and a diversified portfolio of value-add and cash-flowing projects.

The fund has a 7% preferred return rate with three classes of units:

Class A – (80/20) ($1,000,000 +) in which investors get 80% and managers get a 20% performance fee

Class B – (70/30) ($500,000-$999,999)

Class C – (60/40) ($100,000 – 499,000)

This fund works particularly well if your goals are focused on quadrant one deals. Within TOF, we try to make sure we stay away from more speculative assets. As much as possible today, it’s a razor focus on quadrant one deals. Cash flowing defensive characteristic means everything to us today.

Wrap-Up

Both funds offer diversification into real estate for investors looking for alternative investment methods. If you’re interested in moving money to real estate as investments, consider our latest fund, the Tempo Growth Fund LLC.

You can contact myself for more information on Tempo Growth Fund (weblink: tempogrowthfund.com). I can be reached at Mike@tempofunding.com or by phone at 917-806-5029. If you’d prefer to have a conversation, please feel free to reach out to me on the number above or at bigmikecall.com where we can schedule a Q & A.

Thanks for Reading!

Mike Zlotnik

Please don’t miss the latest Episodes on Big Mike Fund Podcast:

057: Covid-19 and the Volatile Stock Market

Thanks for reading!

Mike Zlotnik

CEO, TF Management Group LLC

This newsletter and its contents are not an attempt to sell securities, nor to sell anything at all, nor provide legal, nor tax accounting, nor any other advice. The presenter is a private lending and real estate fund management business, and the information represented herein are purely for educational purposes and represents the opinions of the presented. Prior to making any investment or legal decision you should seek professional opinions from a licensed attorney, and a financial advisor.

TF Management Group LLC (TFMG) is an investment fund management company that specializes in both short-term debt financing for real estate “fix and flip” projects, and long-term “value-add” equity deals.