In the November Issue

- What is a Cap Rate?

- How Rising Interest Rates Affect the Real Estate Market

- Examples of How Rising Interest Rates Affect Cap Rates and Asset Prices

- How to Invest with Downside Protection

Interest Rates are Rising and the Cap Rate is Worsening…

Are Your Investments Protected?

In previous newsletters, we’ve explored the implications of rising interest rates and how they might affect the real estate market.

Since 2015, the Fed has increased rates from 0-0.25% to the current 2-2.5%, and they are expected to continue increasing (possibly 5 more times) to around 3.25-3.5% by early 2020. Prior to the 2008 recession, interest rates were much higher, but over the past 8-10 years, the economy has experienced a very low interest rate environment.

It wasn’t until 2016 when the Fed ‘woke up’ and realized they needed to start slowing the economy down by raising rates.

If the current interest rate projections are true, what does this mean for the real estate market and investors alike? We will walk through how interest rates affect cap rates, asset prices, and cash flow for real estate projects and how you can invest with downside protection.

What is a Cap Rate?

To begin, cap rates are a fundamental concept used in the world of commercial real estate including the multi-family, self-storage, retail, office, and industrial space.

*Definition: The capitalization rate (cap rate) is the rate of return on a real estate investment property based on the income that the property is expected to generate. Essentially, it estimates the investor’s potential return on his or her investment.

Cap Rate Example

You acquire a small, commercial property for $1,000,000. The property brings in an annual revenue of $100,000 with operating expenses of $40,000. If the net operating income is $60,000, the cap rate would be 6%.

It’s important to note that cap rates and asset prices have an inverse relationship. Assuming NOI is a fixed number at a point in time, when an asset price decreases, the cap rate goes up. When the cap rate goes down, price increases.

*We will explore this topic more in depth further in the newsletter.

What Do Cap Rates, Asset Prices, and Cash Flow Look Like in an Age of Rising Interest Rates?

In today’s market, cap rates are historically low, meaning, investors are paying exceptionally high prices for assets. In other words, investors are overpaying for the net operating income derived from these assets.

With the Fed likely to continue raising interest rates, what is the effect on cap rates, asset prices, and cash flow?

Higher interest rates work like gravity, pulling back on real estate prices and increasing cap rates.

However, there is a dichotomy between interest rates and CAP rates in the current market. Interest rates on mortgages have been rising, but CAP rates have stayed somewhat stagnant creating a disparity between what sellers are asking and what buyers should be willing to pay. In turn, investors should be willing to accept lower returns because they they could pull their money out of the investment and park it in a bank rather than take a risk with higher interest rates.

Because of this reality, project sponsors need to know how to maintain strong returns in the wake of higher costs. Let’s take a look at how higher interest rates affect the price at which project sponsors need to acquire projects.

Example: How Higher Interest Rates Affect Cash flow, cap rates, and asset prices

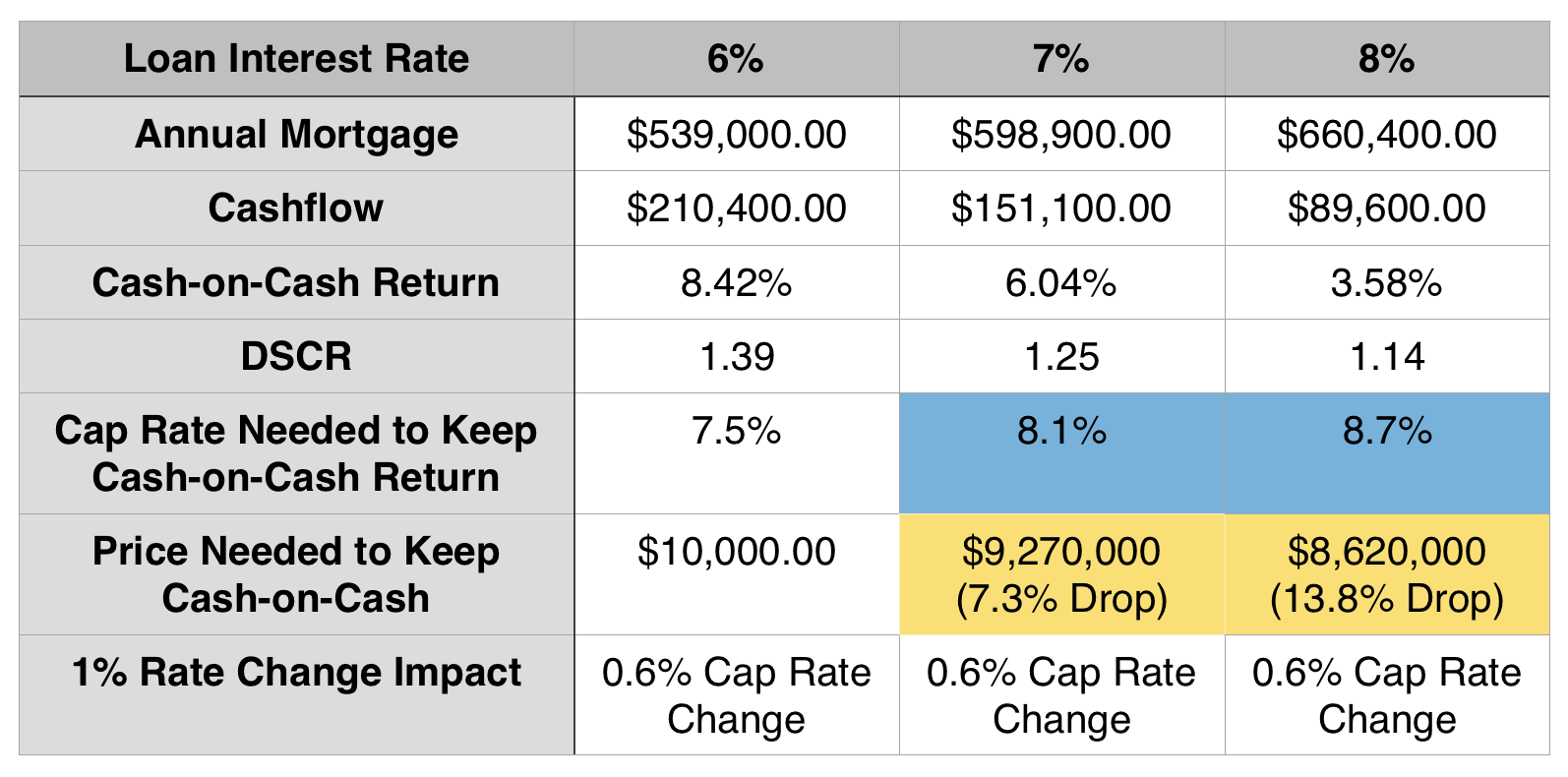

You acquire a commercial property for $10,000,000 with a down payment of $2,500,000 (25%). You take out a 30 year amortization loan for $7,500,000. This property yields gross annual rents of $1,000,000. With operating expenses at $250,000, the net operating income becomes $750,000. With these numbers, let’s compare the cap rate and acquisition price across three different interest rates:

Equations to note:

In this example, we are assuming the investor wants to maintain a cash on cash return of 8.4%. If interest rates increase to 8%, the investor would need to acquire the property at a price of $8,620,000 with a higher annual mortgage payment. The cap rate also increases and the DSCR moves downward at a ratio level that most banks will not accept.

*Investor Note: Most banks will accept a DSCR of 1.2-1.125 as a minimum requirement. Higher is better (safer).

This illustration purely shows the effect that interest rates can have on investors. If interest rates were to increase to 8%, the investor would need an asset price drop of nearly 13%.

Now let’s look at how higher interest rates can affect value-add properties.

Example: Impact of Interest Rate Increases on Value-Add Project Profitability and IRR

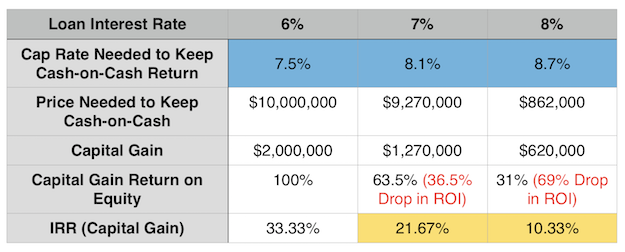

Let’s assume you acquire a property for $7,000,000 and invest an additional $1,000,000 into the property through renovations, etc. A life cycle for a value-add project is typically around 3 years (factoring in time for renovations, tenant changes, and cash flow to begin).

You obtain a $6,000,000 loan from the bank. Once all renovations are completed, you generate a NOI of $750,000.

*For this example, we are ignoring bank closing fees, etc.

The IRR is essentially an annualized internal rate of return, so you would divide the capital gain return on equity by 3 to get the IRR.

If interest rates increase to 7%, the project sponsor might be forced to exit the asset at a price of $9,270,000. This means they will obtain a capital gain of only $1,270,000 resulting in a 63.5% return over the three years… a significant drop from the previous 100% return. In other words, as interest rates increase, so do the cap rates, reducing asset values on the sale, and thereby cutting ROI (lower Internal Rate of Return).

As you can see, a small change in the interest rate or cap rate significantly impacts the overall project profitability.

Impact of Rising Interest Rates on Real Estate

Is it possible for asset prices to remain the same even when interest rates increase?

Yes! Asset prices could stay the same but only if there is an improvement in gross rents and NOI for real estate assets. In theory, rents need to increase faster than interest rates in order to maintain the same asset price.

In the long run, real estate acts as a hedge against inflation. As rents increase and the debt amount is fixed, inflation will decrease the value of the debt over a long period of time.

In the short run, however, quickly rising interest rates could lead to a debt crisis. For example, if you financed a commercial property with a 5/1 ARM in 2015 at a rate of 4.5%, you may be required to refinance in 2020 when the rates could be as high as 7.5%.

This refinancing will require a significant amount of equity capital contribution or the debt service coverage ratio will not meet bank requirements. The higher interest rates will require NOI to be growing faster than the debt service on a given loan.

It’s important to understand that rising interest rates is not the problem… the velocity at which they are rising is. The Fed is trying to cool down the economy because unemployment is low and many assets are overleveraged.

So how can you prepare (and protect) your investments for rising interest rates?

5 Ways to Prepare for Rising Interest Rates

Refinance now and lock in current interest rates

The best mitigation strategy for your investments is to refinance now before interest rates get any higher. Take advantage of fixed, long term rates. Another strategy in conjunction with refinancing is to reduce leverage on projects with variable interest rates. Paying down debt will reduce your debt service ratio and make your investment safer. One way you can pay down debt is by taking on equity partners.

Find good partners

Partners will diversify your risk and significantly reduce your downside when investing in real estate– they could be credit partners, experience partners, capital partners, etc. In a time when preparing for an economic downturn is more important than reaping upside rewards, partners is a great strategy to protect your investments.

Increase cash reserves

Cash reserves are key in times of debt crisis. Cash is earning higher interest rates and it can be used to pay down the debt if variable rates continue to rise. It also becomes handy when market correction kicks in and better opportunities come to the table.

Diversify Investments

One of the best strategies to mitigate risk is to diversify your investments across various sectors, regions, project sponsors, fund managers, etc. The more diverse your portfolio is, the more prepared you are for an economic downturn.

Focus on strong cash flow

Invest in deals with higher DSCR and long-term fixed interest rates. You will have the cash flow needed to survive an economic recession, periods of higher vacancy, and market fluctuations.

![]()

Types of Investments With Downside Protection

Now that we’ve given you ways to mitigate risk in the wake of rising interest rates, let’s discuss the types of investments to look for with downside protection.

Investments with partners you trust

If you invest with partners, make sure you conduct due diligence beforehand. You want to invest with people who have integrity, an experienced track record, and a conservative investment philosophy. In today’s age, it’s better to prepare for a downturn rather than over-leverage and take advantage of risky deals.

Value-add Projects

Why value-add projects? These types of investments have increasing cash flow due to value add work. Most of these properties are run down and underperforming, so there is great opportunity for increased forced appreciation. They typically result in higher rents and better cash flow once renovations are complete, so in the event of an economic downturn, they value of these assets increase because they generate better cash flow. If the market corrects and the prices come down, you are protected by the forced appreciation. A higher level of equity is built throughout the project.

Invest in short duration loans and debt secured by quality assets

Be sure to invest in loans with a LTV of less than 75%. You will get a lesser rate of return on a lower LTV, but it creates a higher degree of safety. In addition, make sure the projects have a clear exit strategy.

Within each of these investments, there is also the question of “Do I invest in individual deals or funds?” Each have their own pros and cons, but funds allow you to passively invest in a diversified portfolio of projects. The Tempo Opportunity Fund LLC specifically focuses on value-add projects because of their strong cash flow and protected value during economic downturns.

If you would like to learn more about the Tempo Opportunity Fund, feel free to visit www.https://tempofunding.com/investors/ or contact us and we would be happy to walk through investment opportunities with you.

You can also watch Mike’s latest webinar on the topic of rising interest rates at https://tempofunding.com/education/.

Thanks for reading!

Mike Zlotnik

CEO, TF Management Group LLC

This newsletter and its contents are not an attempt to sell securities, nor to sell anything at all, nor provide legal, nor tax accounting, nor any other advice. The presenter is a private lending and real estate fund management business, and the information represented herein are purely for educational purposes and represents the opinions of the presented. Prior to making any investment or legal decision you should seek professional opinions from a licensed attorney, and a financial advisor.

TF Management Group LLC (TFMG) is an investment fund management company that specializes in both short-term debt financing for real estate “fix and flip” projects, and long-term “value-add” equity deals.