Investors today are constantly being flooded with headlines about Federal Reserve Chair Jerome Powell, pressure on the Fed from the Trump administration, and the ongoing debate over the future of interest rates. While these stories generate a lot of noise, they don’t always help investors understand what truly drives the markets or how to position their portfolios.

The truth is this: the interest rate environment is more likely to ease in the years ahead—regardless of political infighting or Fed rhetoric. That shift won’t come from soundbites; it will come from structural economic realities that make high rates unsustainable.

In this article, we’ll explore five key reasons why lower interest rates are likely to occur, what that means for investors, and how Tempo positions portfolios to thrive through market cycles.

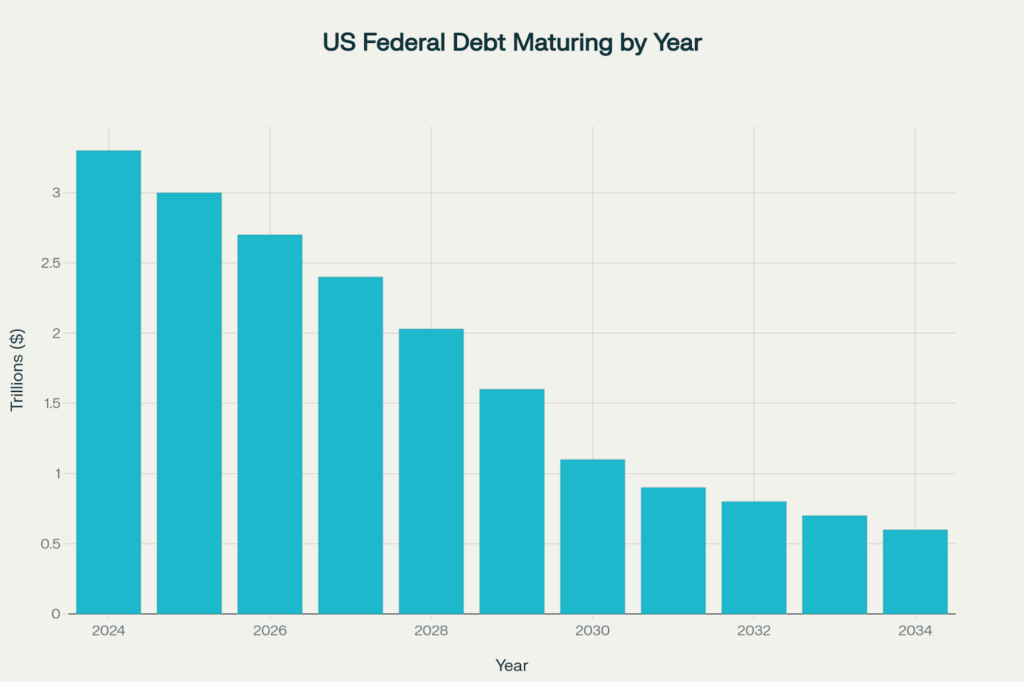

The Debt Burden Is Too Heavy to Sustain Higher Rates

One of the clearest signals that rates cannot stay elevated indefinitely is the government’s debt servicing burden.

- Just thru mid-2025, approx. $132B in U.S. Treasury securities matured on June 30 alone, with another $15B in interest payments due the same day (CBO).

- Roughly 30% of U.S. debt matures within the next five years and 62% of U.S. debt matures within the next nine years (St. Louis Fed, FRED).

When trillions of dollars must be rolled over at much higher interest rates, the government’s interest expense balloons. The debt service alone risks crowding out other spending priorities, from defense to infrastructure, and ultimately weighs on economic growth.

This creates a structural incentive for rates to move lower over time—politics aside.

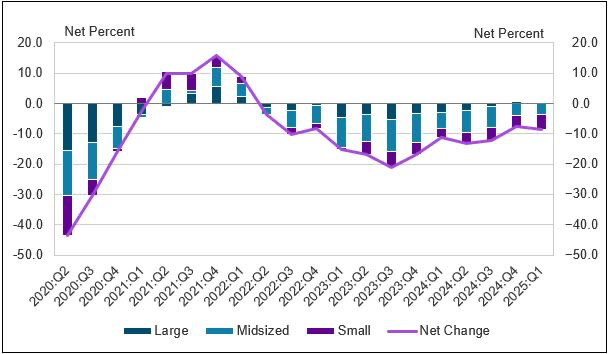

Small Business Lending Has Dried Up

Small businesses represent the backbone of the U.S. economy, driving job creation and innovation. Yet they are among the hardest hit by high interest rates.

- According to the Kansas City Federal Reserve, new small business lending fell sharply in 2024, even as overall balances increased modestly. This indicates that many small firms are being priced out of credit or discouraged from borrowing altogether (Kansas City Fed).

Small businesses account for nearly half the US GDP – historically ranging between 43.5% and 50.7% – and the health of this sector is imperative to growth and stability in the US economy. (US Chamber of Commerce)

When the small business sector can’t access affordable financing, the ripple effects hit employment, wages, and local economic vitality. Policymakers and markets alike recognize the urgency: without lower rates, growth stalls at the grassroots level

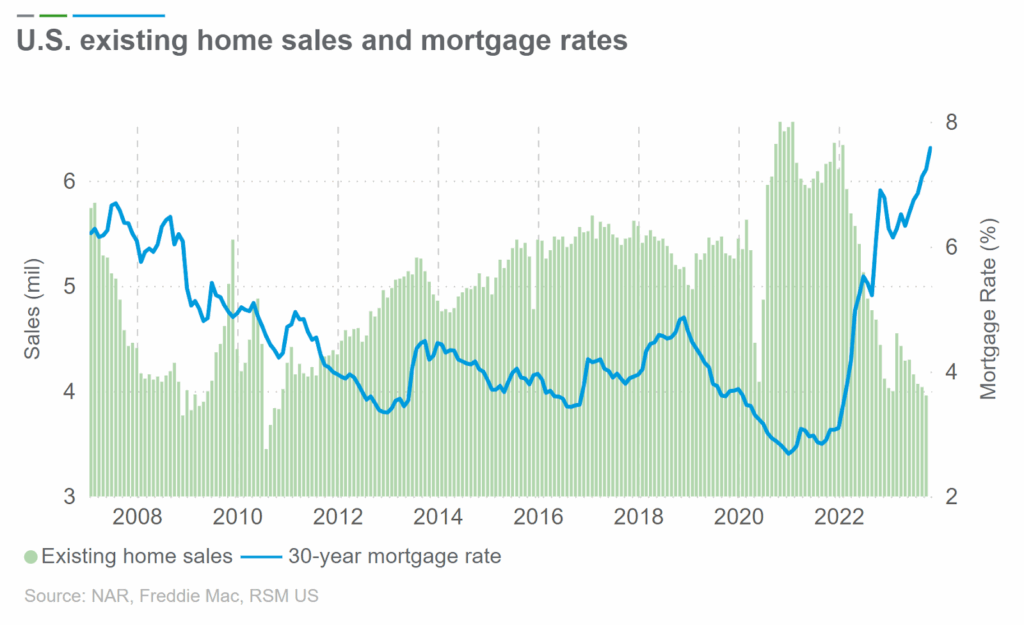

Housing Market Activity Has Slowed

The housing market, traditionally one of the strongest engines of U.S. economic activity, continues to suffer under the weight of higher mortgage rates.

- New single-family home sales fell 0.6% in July 2025, down 8.2% from the prior year, with average mortgage rates holding around 6.58% (Reuters).

- Existing home sales ticked up just 2% in July to 4.01 million annualized units—only 0.8% higher than a year earlier (Reuters).

- The median existing-home price hit $435,300 in June, the highest on record, while sales fell to their lowest level since late 2024 (WSJ, Barron’s).

This dual challenge—soaring prices and elevated borrowing costs—locks out first-time buyers and discourages existing homeowners from moving. As one of the largest contributors to U.S. GDP, housing must recover for growth to accelerate, which will require easier credit conditions.

Auto Sales Are Sluggish

The auto industry, another key contributor to the economy, has also slowed under the weight of high financing costs.

- Auto manufacturing and sales represent roughly 3%–3.5% of U.S. GDP and directly employ more than 1.7M Americans (Center for Automotive Research).

- Despite vehicle output reaching nearly $587B in 2023, sales volumes have softened as consumers shy away from expensive car loans and leases (BEA).

Sluggish auto sales not only impact manufacturers but also ripple through related industries—steel, electronics, transportation, and retail finance. Sustained strength in this sector is virtually impossible with borrowing costs at current levels.

Consumers Are Pulling Back

High interest rates don’t just hurt businesses—they also strain household budgets.

- Retail sales slowed in April and May 2025, before rebounding slightly with a 0.6% increase in June, about 4% above the prior year (U.S. Bank).

- Consumer sentiment rose to 61.8 in July 2025, its highest in five months, but remains weak compared to historical averages (Trading Economics).

When households cut back on discretionary spending—whether on cars, appliances, or vacations—the broader economy slows. Consumer-driven growth accounts for nearly 70% of U.S. GDP, making rate relief essential for sustaining momentum.

Why Fed and Political Theater Doesn’t Change the Outcome

While the Fed's Jerome Powell and the Trump administration may disagree on policy, economic gravity always wins. The Fed can talk tough, and politicians can posture, but when debt costs, small business credit, housing, autos, and consumer spending all flash red at once, easing becomes inevitable.

History reinforces this pattern: after periods of aggressive tightening, interest rates eventually normalize as growth slows and inflation stabilizes.

What This Means for Accredited Investors

For investors seeking stability, diversification, and passive income, this environment creates opportunity:

- High Rates Today = “Deep Value Opportunities”: commercial real estate assets are priced at tremendous discounts to market in the current interest rate environment, for those who have capital ready to deploy.

- High Rates Today = Strong Private Credit Returns: with underwriting constrained for traditional debt, or well positioned properties needing supplemental capital to reposition, there is the opportunity for very strong returns in private credit mezzanine / bridge debt financing.

- Tempo’s Investments Provide Balance: with income-focused debt strategies and value-add equity positions, we prepare portfolios for both resilience now and growth later.

- Freedom from Political Posturing and Fed Noise. Our disciplined underwriting and sponsor relationships allow investors to focus on results, not headlines.

Tempo’s Perspective

At Tempo, our mission is to help investors achieve financial freedom through education, transparency, performance, and trust. By staying grounded in fundamentals rather than speculation, we structure portfolios to generate steady passive income today while positioning for growth when rates inevitably move lower.

Conclusion: Positioning Ahead of the Shift

The signs are clear: debt burdens, weak small business lending, frozen housing, sluggish auto sales, and strained consumers all point to one outcome. The interest rate environment must ease, regardless of the Fed’s rhetoric or political pressure.

For accredited investors, the key is to align capital with strategies built for resilience today and opportunity tomorrow. That’s the Tempo approach.

We are currently targeting “deep value buy” opportunities where there has been a great discount to market pricing – and there are clear investment fundamentals of strong cash flow and asset value appreciation through the hold period. We are currently targeting opportunistic and strong investments in retail / open air shopping, industrial, private credit, multifamily, and self storage – among other asset types.

Market Outlook: with interest rates forecasted to come down over the next 12 – 24 months, industry consensus is that commercial real estate values will continue to show signs of value stabilization and rebound nicely from historic lows. Lower interest rates are expected to function as tail winds to the broader commercial real estate industry. The reinstatement of bonus depreciation is only just now starting to reverberate though the industry as well. We believe that there is a window of opportunity today to invest in what we consider “deep value” real estate assets at steeply discounted prices.