Navigating Market Uncertainty: Inflation, Interest Rates, and a Deep Value Investment Opportunity

The financial landscape continues to evolve, with recent inflation data highlighting key areas of concern. Investors are closely watching economic indicators, market movements, and policy decisions to determine the best path forward. Let’s break down the latest developments and explore a rare investment opportunity that stands strong amid uncertainty.

Key Economic Factors Impacting the Market

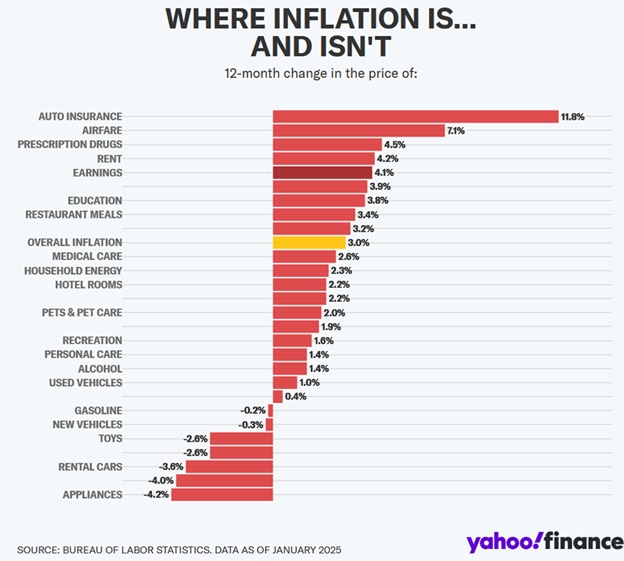

- Rising Consumer Prices

- January 2025 CPI came in at 3.0%, increase from December 2.9%, “hotter” than expected.

- The price of eggs surged by 15.2%, reflecting continued pressure on food costs.

- Used car prices saw a significant increase of 2.2% in January, up from 1.2% in December, signaling a renewed push in demand.

- The cost of shelter rose by 4.4% annually, marking the smallest 12-month increase in three years, a slight sign of easing but still an area of concern for affordability.

- Market Reactions to Inflation Data

- Stock market futures dropped ~1% in response to the latest inflation report.

- Bond yields rose by about 0.10%, indicating investor nervousness and expectations that the Federal Reserve may remain cautious in adjusting rates.

- Federal Reserve’s Stance on Monetary Policy

- On February 11th, Federal Reserve Chair Jerome Powell testified before the Senate, reiterating a “I would say we’re we’re close but not there on inflation”.

- “I would say we’re we’re close but not there on inflation,” Powell said February 12th in an appearance before House lawmakers

- The Fed remains in no hurry to adjust monetary policy, suggesting that rate cuts or hikes will be contingent on further economic data.

- Trade Policy and Inflation Uncertainty

- The new administration’s stance on tariffs has added another layer of uncertainty to the inflation outlook.

- Shifting trade policies may impact economic growth, supply chains, and business confidence in the coming months.

Finding Stability Amid Uncertainty: A Prime Investment Opportunity

While market conditions remain uncertain, one thing is clear: strategic real estate investments can offer stability and significant upside.

Introducing Waverly on the Lake – a deep value buy that stands out in today’s economic climate. Here’s why this investment is a rare find:

- Purchased at a going-in CAP rate over 9%, a compelling valuation in today’s market.

- Existing rents are well below market rates, providing built-in growth potential.

- 6% cash flow from day one.

- 20-22% conservative IRR target, with 2.37x EM.

- Planned energy-efficient improvements and renovations to classic units will drive substantial rent growth and utility cost savings.

- Located on a beautiful 10-mile-long lake, offering both a strong rental demand and an attractive lifestyle appeal.

- An institutional-quality multifamily property that is not easy to find at such favorable terms.

This is a home-run opportunity, presenting strong cash flow, capital appreciation potential, and a hedge against inflation.

Click here to learn more about this exclusive investment and secure your position in a resilient, value-driven asset.