Tempo thrives in dislocation – pivoting with the market to capture deep value buys and create lasting impact for investors and partners.

At Tempo, we believe the best opportunities often appear where others are unwilling – or unable – to look. In today’s environment of rising capital costs, shifting consumer behaviors, and legacy debt structures under pressure, many investors are retreating. We see it differently. Market dislocations, when paired with discipline and focus, create the conditions for deep value buys – opportunities to acquire fundamentally strong assets at significant discounts.

These are not speculative gambles. They are targeted, data-driven investments where short-term inefficiencies have pushed pricing below intrinsic value. By leaning into contrarian theses, applying rigorous underwriting, and acting with nimbleness, we are uncovering opportunities that can generate outsized returns while supporting the long-term health of the assets themselves.

Below are three areas where Tempo has identified—and executed on—such opportunities.

Retail Resilience: The Headquarters at Seaport, San Diego Waterfront

Retail has been declared “dead” more times than we can count. Yet, the numbers tell a very different story. In well-located, supply-constrained markets, retail has not only endured but thrived. Strong demographics, irreplaceable locations, and the experiential demand for physical spaces have supported sustained performance across many retail formats.

Tempo’s recent acquisition of Headquarters at Seaport in San Diego (photographed above), closed in August 2025, is a prime example. For years, the property had been under the stewardship of a legacy seller that failed to keep pace with capital improvements. Deferred investment led to vacancy issues and the perception of weakness. Vacancy fell to almost 18% in a prime downtown core property that was still well trafficked. As a result, the asset has now traded at a meaningful discount relative to its true potential – over a 9% cap rate, with what we estimate is upwards of a 25-35% discount on relative value.

What we saw in this investment was not a dying property, but a classic case of value trapped by neglect. With the right capital plan, tenant engagement strategy, and operational improvements, the Seaport property stands to reclaim its position as a vibrant retail hub in a market with limited alternatives. The contrarian bet on retail is already being validated by performance data across similar assets nationwide, and this acquisition puts us in position to ride that wave from a basis far below replacement cost.

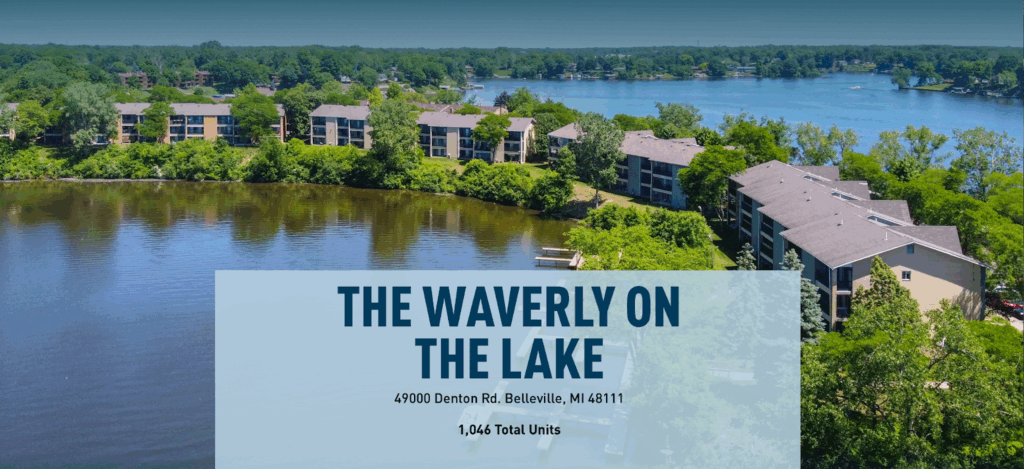

Multifamily in Transition: Waverly on the Lake

The multifamily sector has long been seen as a safe harbor for institutional capital, but the last cycle created distortions that are now coming undone. Between 2019 and 2022, assets were routinely acquired at historic low cap rates, fueled by bridge debt and underwriting that assumed perpetual rental growth.

When interest rates rose and rental growth normalized, the math no longer worked. Debt service coverage deteriorated, and many of these once-prized properties are now facing distress as maturities arrive.

Waverly on the Lake illustrates this shift. Acquired in the prior cycle under overly aggressive assumptions, the property now sits at the center of a capital structure mismatch. Yet beneath the distressed paper lies a fundamentally sound asset: well-located, in-demand, and supported by durable tenant demand. When we invested in this property at this beginning of this year, it was selling at nearly a 9% cap rate, at a price per door of $79k and had a ton of value-add improvements to deferred maintenance issues ready to go. Comparable stabilized multifamily properties sell well into the mid-$150k per door range leaving tremendous upside opportunity.

For disciplined investors, this environment creats the chance to buy strong properties at historic discounts, reset basis, and reintroduce operational stability. By bringing conservative underwriting and long-term capital to bear, assets like Waverly can not only recover but thrive, delivering value that short-term-focused owners missed.

Industrial Looking Forward: Sale-Leaseback Opportunities

While we continue to execute on retail and multifamily dislocations, Tempo is also looking ahead. One of the most attractive opportunities we see emerging is in industrial real estate, particularly through sale-leaseback transactions.

Here, legacy businesses – many of them profitable, established operators – are reassessing their capital structures. By selling their real estate and leasing it back under NNN terms, they unlock liquidity to shore up balance sheets, invest in growth initiatives, and reposition for long-term competitiveness.

For investors, these transactions offer exposure to high-quality industrial properties at attractive cap rates in the 8% cap rate range – which is at a serious discount to relative value not long ago. These properties are secured by tenants with strong incentives to remain. The industrial sector has consistently demonstrated resilience and demand growth, driven by logistics, e-commerce, and supply chain reconfiguration. Sale-leaseback opportunities not only align with these macro trends but also deliver a win-win outcome: businesses get the flexibility they need, and investors capture stable, long-duration cash flows from a sector that continues to outperform.

The Common Thread: Dislocation as Opportunity

What ties these examples together—retail, multifamily, and industrial—is a simple truth: market inefficiencies create opportunities for those prepared to act. Legacy owners unwilling to reinvest, aggressive buyers overexposed to debt, and operating companies rethinking balance sheets all contribute to today’s landscape of discounted assets.

For many, these conditions are intimidating. For Tempo, they represent the precise environment where we thrive. Our ability to move quickly, underwrite rigorously, and pivot into asset classes where others hesitate gives us an edge. We don’t chase trends; we lean into value.

The Tempo Advantage: Nimble, Disciplined, and Aligned

Tempo’s strategy is built on three pillars:

- Nimbleness – We adapt to where the market is moving, not where it has been. This allows us to seize opportunities across sectors rather than remain locked into a rigid playbook.

- Discipline – Every acquisition is underwritten with a long-term perspective, stress-tested against real-world assumptions, and structured to withstand market volatility.

- Alignment – Our success is tied directly to the success of our investors and partners. We focus on creating value in ways that are tangible, durable, and mutually beneficial.

This is what allows us to bring real value not only to our investors but also to the sponsors and operating partners with whom we collaborate. We understand that deep value buys are not just about securing discounts—they are about unlocking potential and repositioning assets for sustainable performance.

Conclusion: Building Value Through Market Cycles

Today’s market is challenging, but challenges breed opportunity. By going where others are reluctant to go—whether that means doubling down on retail, acquiring multifamily assets at distressed pricing, or engaging in forward-looking industrial sale-leasebacks—Tempo continues to identify and capture deep value buys.

Our track record demonstrates that true value is found not in chasing what’s popular, but in seeing what’s overlooked. With the discipline to underwrite correctly, the nimbleness to adapt, and the alignment to partner effectively, we are well-positioned to continue generating strong results in today’s environment and beyond.

At Tempo, we don’t just find value—we create it.

Ready to learn more about how Tempo is uncovering deep value opportunities in today’s market? Schedule a call with our team to explore how we can create lasting value together.