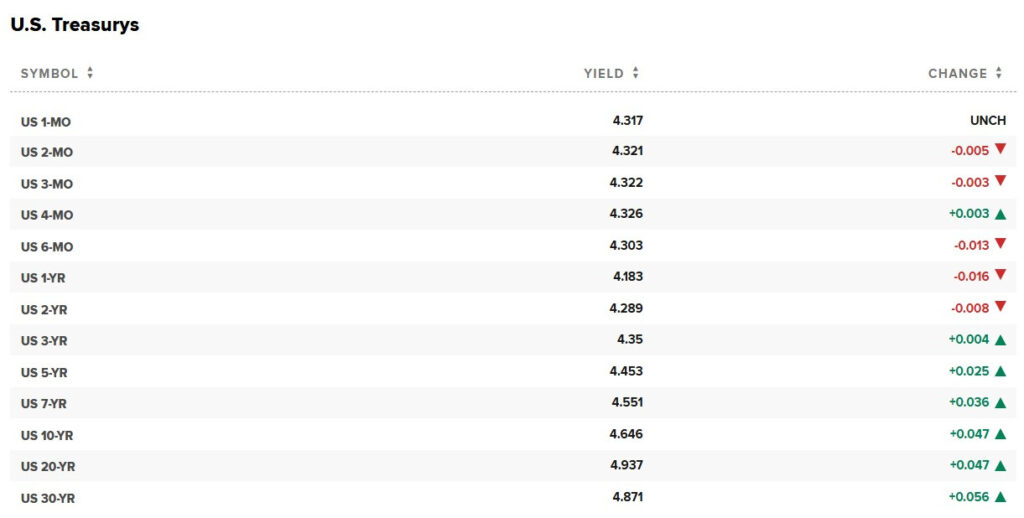

Some investors have asked why they should consider Waverly versus keeping their money in US Treasuries, which currently yield 4-5%. Let’s break it down:

Current Bond Yields Snapshot (as of January 2025):

- Short-Term Treasuries (1 year or less):

- Yields ~4.25%.

- Minimal fluctuation with interest rate changes.

- Medium- to Long-Term Treasuries (1-5+ years):

- Yields 4.2-4.9%, but returns are highly sensitive to interest rate movements.

- Rising rates can decrease bond values, leading to potential losses despite the “risk-free” label when held to maturity.

Source: https://www.cnbc.com/bonds/

Comparing Risk and Reward: Waverly vs. Treasuries

While Treasuries are known for their safety, they also offer limited upside and carry risks related to interest rate volatility. By contrast, Waverly offers a compelling asymmetric risk-reward profile, with strong upside potential and mitigated downside risks:

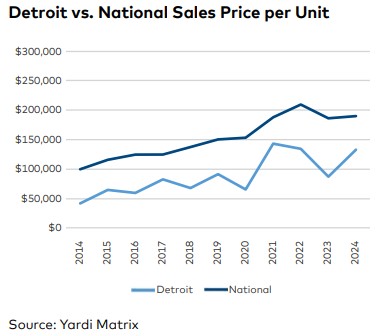

- Deep Discount Buy: Assets like Waverly are trading at 20-30% below peak market prices (2021-2022), creating opportunities for significant appreciation.

- Immediate Cash Flow: Waverly’s projected 6%+ annual cash flow exceeds the yields of Treasuries.

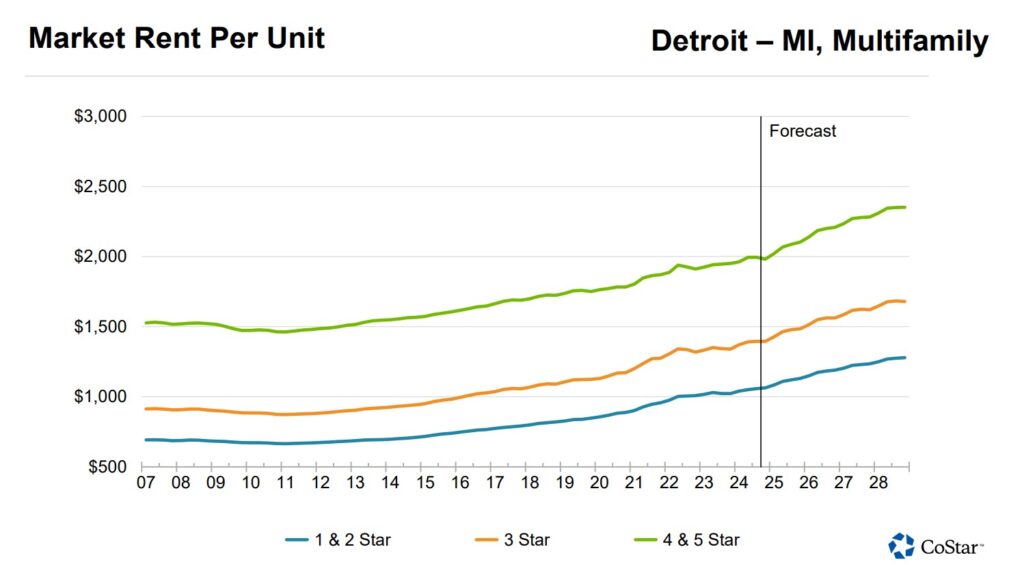

- Forced Appreciation: Value-add renovations, rent growth, and operational efficiencies provide returns independent of market appreciation.

Scenario Analysis: How Waverly Performs Under Different Economic Conditions

If Interest Rates Rise (Higher Inflation):

- Bonds: Medium- to long-term bond prices would fall, likely resulting in negative net returns.

- Waverly: Higher inflation often drives rent growth, especially in stable markets like the Midwest. Rent increases offset higher costs and boost NOI, making real estate an excellent hedge against inflation.

If Interest Rates Fall (Cooling Economy):

- Bonds: Falling rates would increase bond values, boosting returns for medium- and long-term Treasuries.

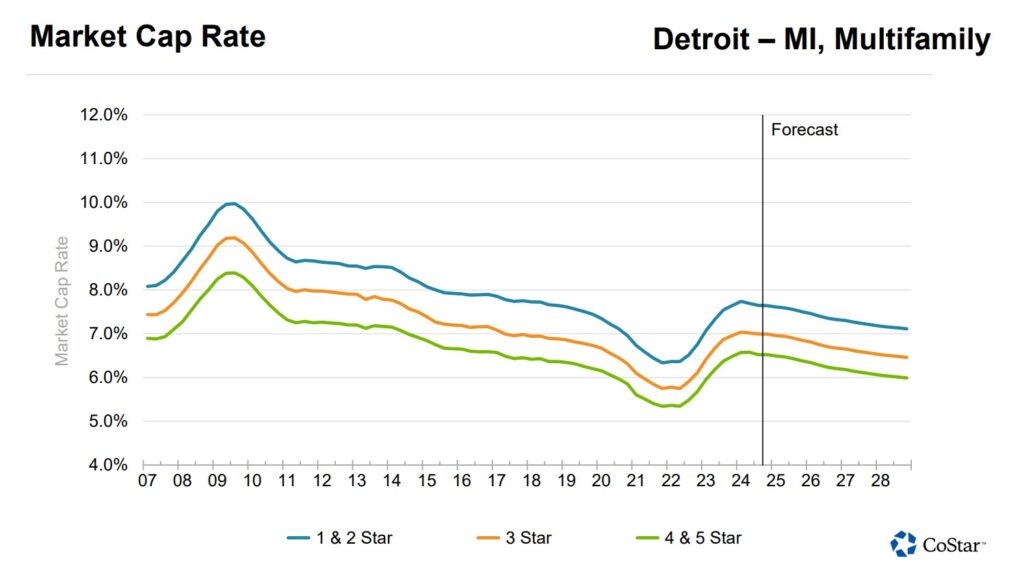

- Waverly: Lower interest rates would enhance CRE valuations and cash flows, improving projected returns. Cap rate compression in such scenarios could further boost Waverly’s IRR and equity multiples.

Where Are We in the CRE Market Cycle?

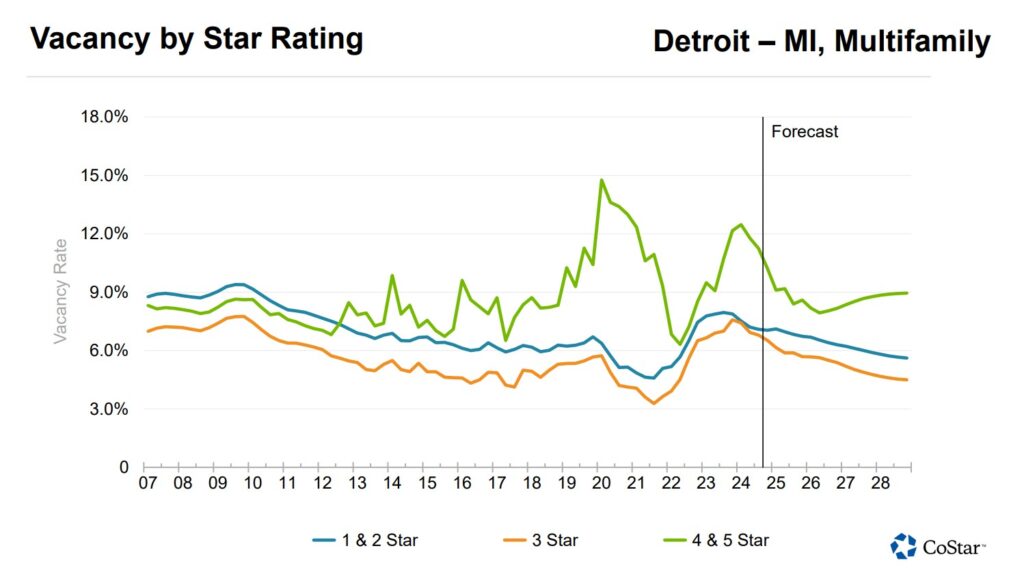

The commercial real estate market appears to be near the bottom of the cycle or in the early recovery phase. The rapid rate hikes of 2022-2024 pushed the market into a recession, skipping the oversupply phase entirely. With new construction activity significantly slowed and rents continuing to rise steadily, multifamily assets like Waverly are well-positioned to benefit from improving market dynamics in 2025 and beyond.

Why Waverly is a Strong Investment Today

Sitting in short-term Treasuries may provide stability but offers limited upside. Longer-term Treasuries carry significant risks tied to interest rate volatility. In contrast, Waverly on the Lake provides:

- Immediate cash flow exceeding Treasury yields.

- Strong upside potential from value-add renovations and a deep discount purchase price.

- Inflation hedging benefits through rent growth and NOI improvements.

This is the type of deal that delivers both short-term cash flow and long-term appreciation while mitigating risks through careful underwriting and operational expertise.

Waverly on the Lake: A Deep Value Opportunity in Multifamily Real Estate

We are thrilled to present Waverly on the Lake, a 1,046-unit value-add multifamily property near Ann Arbor, MI. This project represents a deep value opportunity, offering significant upside potential while delivering immediate cash flow. Here’s why we’re excited about this deal:

- Exceptional Value: Purchased at $79K/door with in-place average rents of ~$1,165.

- Strong Returns: Projected initial cash flow of 6%+ annually with a going-in cap rate of ~9%.

- Upside Potential: Significant value-add opportunities, including renovations of ~600 classic units and energy-efficient HVAC upgrades. These enhancements will reduce tenant utility costs, lower insurance premiums, and qualify for utility reimbursement programs—a win-win for tenants and investors.

- Targeted Returns: Conservatively underwritten to deliver a 20-22% IRR to investors

Learn More About Waverly on the Lake

Waverly is a rare opportunity to enter the multifamily market at a time when values are deeply discounted, and upside potential is significant. Ready to learn more?

Explore Waverly on the Lake Here

Explore Waverly on the Lake Here

Have questions or want to discuss the details?

or reach out directly!