In the April Issue

- Investment Grade Vs. Speculative Grade Projects

- Income Vs. Growth Funds

- Characteristics of a Private Placement Memorandum funds

A Fresh Look at Real Estate Funds

We’ve discussed real estate funds in the past, but this month, we are bringing a fresh perspective to real estate funds, how they are structured, and various characteristics to consider before investing in a fund.

First, let’s review the major types of funds available today.

There are publicly traded funds like REITs and private funds, ones that are not publicly listed but are offered through private place memorandums (PPMs). You are likely familiar with publicly traded funds– they are traded on Wall Street and offer a diversified option for investors. Often times, these funds are very large but yield lower returns.

On the other hand, private funds are only offered directly by fund managers. These funds can be diversified, vertically focused, or specialty funds. In this month’s newsletter, we are going to focus our attention on private funds and what they offer to you, as an investor.

Investment Grade vs. Speculative Grade Investments

Last month, we explained the investment quadrant and how projects within a fund fall into four categories: Investment Grade Income Focused, Investment Grade Growth Focused, Speculative Grade Income Focused, and Speculative Grade Growth Focused. As a review, let’s look at the differences between investment grade and speculative grade projects.

Each project a fund invests in will fall into one of two categories: Investment Grade or Speculative Grade. Investment grade inherently carries lower to moderate risk versus speculative grade that carries higher risk.

In an investment grade project, the fund’s leverage is zero or very low.

*Note: Leverage lower than 25% is considered low. This means that they’re not leveraging equity money with debt, mitigating a certain level of risk.

For example, if a fund invests in a first year mortgage or deed of trust, they will have a pretty good downside protection. The equity amount will be around 35-40% while the mortgage itself is around 60-65%. This project is not over leveraged which means they can have a better debt service coverage ratio and can hopefully survive an economic downturn more easily than a heavily leveraged project. Another differentiator between the two types of investments is the ability to withstand a stress test. What is a stress test? A 10% stress test is a concept in which when the economy goes into a recession, vacancy is estimated to increase by 10%.If a recession hits the economy, it’s important to know what will happen to your investments and whether or not it would survive a market downturn. For example, if people begin shifting from higher end homes to lower-end, you could expect occupancy levels to drop from 95% to 85%.

Before you invest, ask yourself these questions, “Can this investment withstand this kind of stress test? Will my cash flow still be positive?”. Investment grade projects can typically survive a 10% stress test, but speculative projects may not.

Each type of project can have its own risk and reward. It’s important to invest according to your goals and what you are comfortable with. A few examples of investment grade projects are well-diversified funds, light value add projects, and non-performing note syndications. Speculative grade projects include heavily leveraged syndications, ground-up development, and significant value-add projects.

Characteristics of a Fund

Now that we’ve explored some of the basic structures of real estate funds, let’s dive into the various characteristics of a fund and what to consider before investing.1. Income Vs. Growth

Within investment grade and speculative grade projects, there are a few different strategies a fund can take. They are either income focused, growth focused, or a combination of the two.

Income funds typically invest in debt instruments or cash flow equity with little to no value add. They can be an entirely income investment, leveraged or not. Most of these funds tend to be more conservative.

Growth funds focus on equity investments with a medium to high value add strategy (i.e. projects involving re-development, heavy renovations, etc). They are focused on the appreciation rather than income. This type of strategy has a higher degree of speculation than income focused funds.

Mixed funds will have a combination of projects that focus on growth and income. The Tempo Opportunity Fund LLC is an income and growth funds with a heavier focus on income. Our core investments are investment grade with a few speculative projects. There are some funds, however, that do the opposite and focus on growth with a few income projects.

No strategy is fundamentally wrong; it’s all about understanding their strategy and whether their focus is on investment grade or speculative grade projects.

2. Portfolio Composition

The next characteristic to consider is a fund’s portfolio composition. When analyzing a fund, look at the top assets in the portfolio and determine the percentage of investment grade and speculative grade projects. *Investor Tip: If it’s a ground up development of a self-storage facility, it’s a speculative investment. One important thing to consider when looking at projects is their life cycle. Some projects may be speculative at first, but transition into investment grade say, for example, after construction has been completed.

Once you’ve outlined the type of projects in the fund, the next step is conducting a stress test on the investments to know if they could withstand a market downturn. A portfolio comprised of 75-80% investment grade projects and 25% speculative grade projects is considered a relatively safe investment.

3. Fund Management

Before investing in a fund, it’s necessary to look at the fund’s management, track record, their integrity and so forth.

How well do you know the person who referred you? You need to know, like, and trust the fund’s manager before deciding to invest with them. Try to evaluate their integrity based on all interaction points.

Do they do what they say? How well do they communicate? What happens when there is a bad investment? Consider any flags that are raised in your mind about the fund; invest in what you understand.

4. Open-Ended Vs. Closed-Ended

Another important distinction between funds is whether or not they are open-ended or closed-ended.

Open-ended funds typically continue to raise capital on a periodic basis (usually quarterly, but some do it on a monthly basis). *Note: We are talking specifically about PPM funds. Wall Street funds like REITs trade publicly every day.

You do have some liquidity with private funds, however. Distributions can be reinvested in open-ended funds. Here’s how this type of fund works: The fund manager will purchase assets, sell assets, and reinvest capital into new projects. The net asset value (or price per unit at the end of the period) is computed for each subscription and redemption purpose. The prices are determined by estimated fair market value so the share can be calculated for both investors and people buying in.

On the other hand, closed-ended funds normally raise capital during a certain period of time (i.e. one month, two months, quarters, year, etc.) Once that period of time is over, they will buy into projects and no longer be raising capital. These projects are then run through their life cycle and enter the exit phase. At this point, they liquidate all their assets required for the open period and distribute income to their investors.

One important difference between open-ended and closed-ended funds is that usually you can’t re-invest distributions in a close-ended fund. This is because when they sell assets, they generate tax liabilities for their members and investors, so by not allowing a reinvestment of distributions, the meet these tax liabilities.

Income Distribution

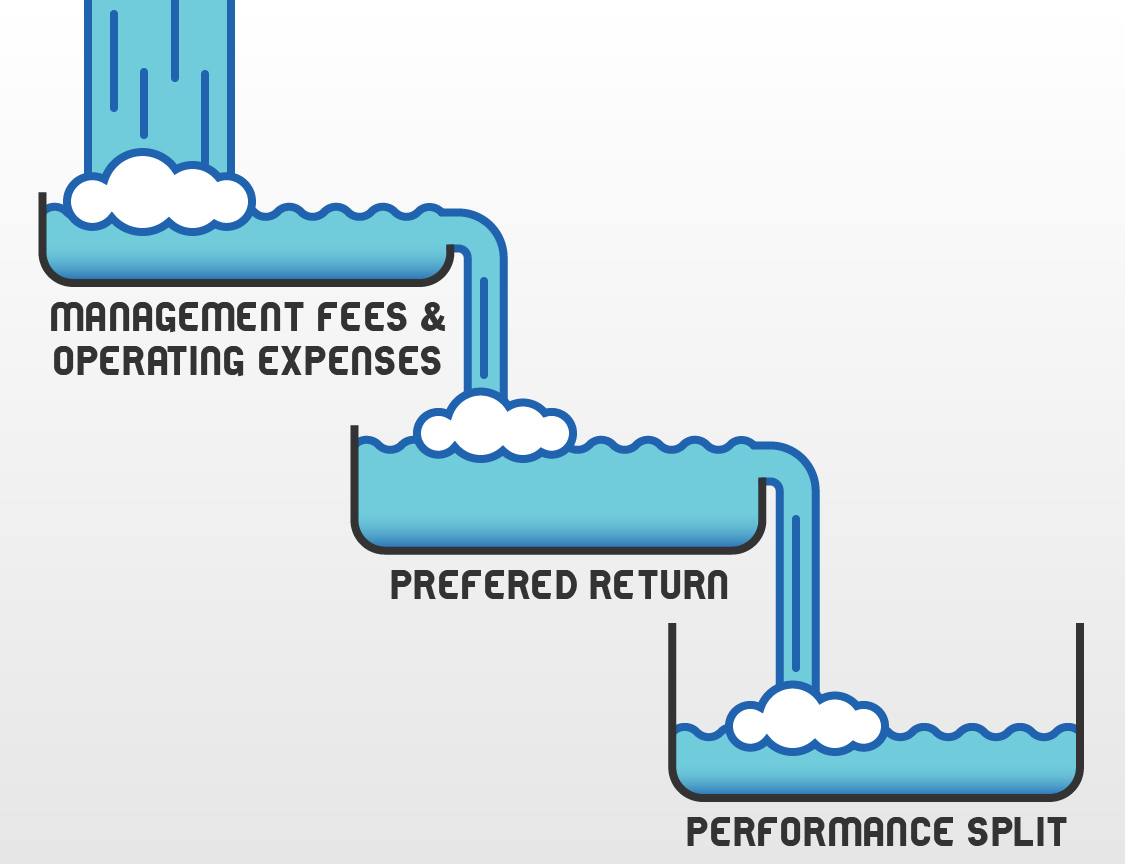

Finally, it’s critical to look at the income distribution in a fund. Investors are compensated through what we call a “waterfall model.” These models can vary, but generally speaking, they follow a similar pattern in establishing properties for how expenses are paid.

Imagine the money flowing through the fund like water. There are different “pools” (people involved with the fund) that need to get “filled (paid) before the money flows into the next pool.

Typically, management fees and operating expenses of the fund are paid first. These fees can vary between funds, so it’s important to know what asset management fees you have to pay up front.

The next payment in the waterfall, the second “pool” is the Preferred Return (often called the “pref”) to investors. This also varies between funds. And finally, the last “pool” in the model involves performance splits, or in essence, profit sharing. It’s important to look at the entire income distribution for a fund and make sure you, as the investor, are getting the good end of the deal.

Wrap-Up

There is no right or wrong fund structure per se, but in our experience, it’s much better for investors to have a preferred return. Though not guaranteed, it creates a structured priority for paying distributions to fund investors first.

We’ve tweaked and tested the Tempo Opportunity Fund LLC to optimize the financial experience for our investors. In doing so, we focus a little more on income, delivering between half and two-thirds of the total return in the form of income and the rest in the form of appreciation.

If you’d like to learn more about our structure or waterfall model, please contact us or visit www.https://tempofunding.com/investors/ and we’ll be happy to answer any questions you may have.

Thanks for reading!

Mike Zlotnik

CEO, TF Management Group LLC

This newsletter and its contents are not an attempt to sell securities, nor to sell anything at all, nor provide legal, nor tax accounting, nor any other advice. The presenter is a private lending and real estate fund management business, and the information represented herein are purely for educational purposes and represents the opinions of the presented. Prior to making any investment or legal decision you should seek professional opinions from a licensed attorney, and a financial advisor.

TF Management Group LLC (TFMG) is an investment fund management company that specializes in both short-term debt financing for real estate “fix and flip” projects, and long-term “value-add” equity deals.