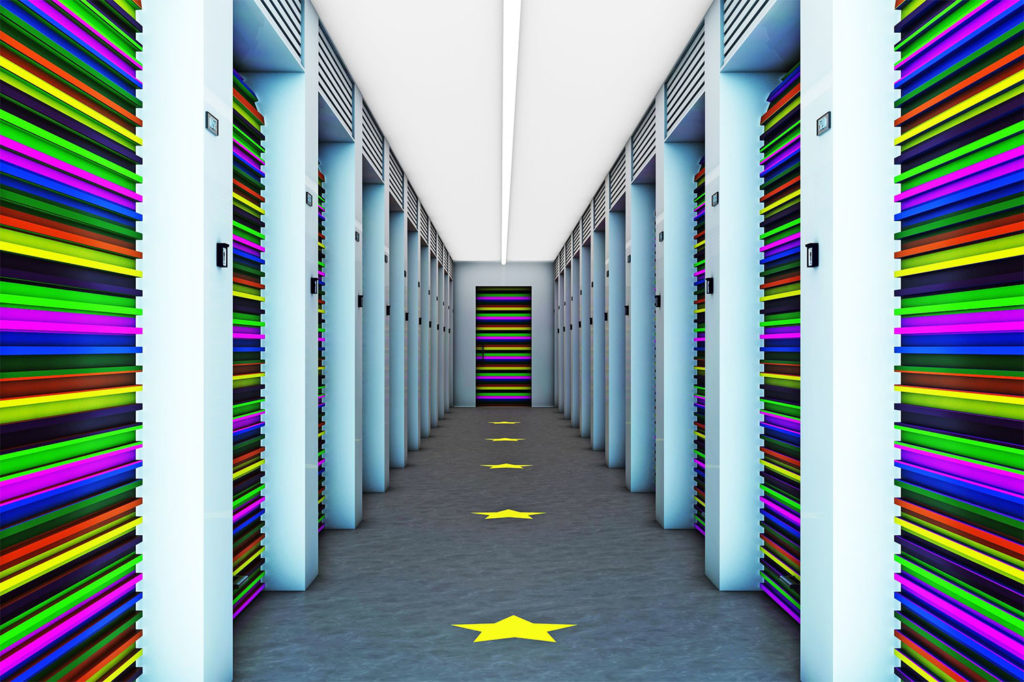

Welcome to The Big Mike Fund Podcast. Today it is my pleasure and a privilege to talk to friend and mastermind brother, Fernando Angelucci, a real estate and self-storage guru. In this episode we talk about self-storage trends, numbers, “eviction” (or in this case, lien) laws, and Fernando’s process. We’ll also chat about the future of self-storage and Fernando’s future projects and opportunities.

Minute Markers:

00:22 – Hello and Welcome

01:00 – Who is Fernando?

03:20 – Eviction and motivating renters to pay

05:25 – Absorption rate lease-up

07:00 – Self-Storage trends

09:00 – Fernando’s Self-storage “eviction” process

11:15 – Buying existing self-storage facilities

16:00 – Fernando’s new projects and opportunities

20:00 – Upcoming deals

23:50 – Bank loan interest rates

27:12 – Delinquencies and occupancy trends for self-storage

31:15 – The near future for self-storage and cap rates

33:00 – Getting in touch with Fernando

00:00 – Thank you for listening to the Big Mike Fund Podcast

Quotes:

“Since the COVID pandemic started and really hit the United States, our occupancies across all of our facilities have actually increased. In some of the facilities where we thought we were at an artificial ceiling on occupancy, we’ve actually exceeded those levels. We’re getting a lot of people coming into the self storage facilities. I think the main reason is self storage serves people in transition.” – Fernando Angelucci

“For maybe every 1 development we do, we’ll buy 10 cash-flowing existing self storage facilities to balance it.” – Fernando Angelucci

“What we’ve noticed is unfortunately for the investors that own assets in the B- and below grade areas—West Side of Chicago, South Side of Chicago—their April 1st delinquencies were massive. Over 60%.” – Fernando Angelucci

“When you have your non-sophisticated sellers (what I call the mom and pops) that may own one or two facilities, those cap rates for us are going through the roof. We’re starting to make blanket offers on any facility that comes in before we even look at it. We’re doing 10% plus cap rate offers and they’re getting accepted.” – Fernando Angelucci

“People are going to step down. Everybody’s stepping down, so the demand for the affordable stuff is increasing while the high-end upgrades people just not. They’re delaying their decisions because of uncertainty.” – Mike Zlotnik

Resources:

LinkedIn: Fernando Angelucci

Twitter: @TheStorageStud